Although the introduction of e-invoices is progressing worldwide, the legal requirements vary greatly from country to country. However, companies that operate internationally must familiarise themselves with the specific requirements of the respective markets in order to avoid legal risks and benefit from the advantages of e-invoicing. digitalization to be fully utilised. In fact, there are differences in the legal requirements for e-invoices in different countries and global developments of various kinds.

Introduction date: When will e-invoicing become mandatory?

The point at which companies have to start using e-invoices varies considerably around the world. Some countries have already completed the introduction, while others are still in the starting blocks.

- GermanyCompanies must use e-invoices for B2B transactions from 1 January 2025, although they can make use of transitional arrangements until 2027.

- France: Companies in the public sector have been issuing e-invoices since 2020, but the gradual introduction in the B2B sector will begin in 2024.

- Italy: Since 2019, companies in Italy have had to comply with both B2B- as well as B2C-issue e-invoices for transactions.

Scope of application: Which transactions are affected?

However, the scope also varies from country to country. Some countries restrict the obligation to certain company sizes or sectors, while others have already introduced more comprehensive regulations.

- GermanyHowever, the regulation only applies to domestic B2B transactions between companies based in Germany.

- ItalyHere, companies have to process both B2B and B2C transactions electronically.

- SpainLarge companies and certain industries are obliged to use e-invoices.

Technical standards: standardised formats?

The technical standards for e-invoices also differ, although the EU has adopted the standard EN 16931 used as a basis. However, many countries have developed additional specifications.

- Germany: Companies use either the formats XInvoice or ZUGFeRD from version 2.0.

- ItalyItaly relies on the country-specific FatturaPA-format, which is strongly adapted to the requirements of the tax authorities.

Transmission channels: How do companies send e-invoices?

The requirements for sending e-invoices are regulated on a country-specific basis, so that some countries allow flexible transmission channels, while others prescribe stricter handling.

- GermanyThere are currently no specific requirements for the electronic transmission channel, so companies enjoy flexibility.

- ItalyHowever, all companies must submit e-invoices via the state system. Sistema di Interscambio (SDI) dispatch.

- FranceFrance, however, is planning to introduce the centralised platform Chorus Proto standardise the sending of e-invoices.

Reporting obligations: Preventing tax fraud

The introduction of e-invoices is intended to help combat VAT fraud in many countries. However, the reporting obligations vary greatly.

- GermanyCompanies will use reporting systems in future to prevent fraud.

- ItalyHowever, companies transmit the invoice data to the tax authorities in real time.

- Spain: Certain companies use the Immediate Information Supply (SII)system to transmit real-time data.

Exceptions and transitional arrangements

However, many countries offer exemptions and transitional arrangements to make the changeover easier for smaller companies.

- GermanyTransitional regulations apply to low-value invoices and tax-free transactions until 2027.

- FranceCompanies are gradually introducing e-billing, with smaller companies having until 2027.

- ItalyMicro-enterprises remain exempt from the obligation under certain conditions.

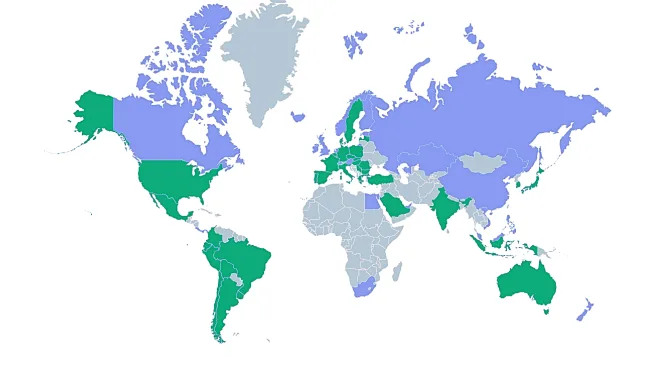

Countries with an existing e-invoicing obligation in the B2B sector

Some countries have already introduced comprehensive e-invoicing obligations for the B2B sector. Particularly noteworthy are:

United StatesThe Business Payment Coalition (BPC) launched a nationwide pilot project to increase the acceptance of electronic invoices, payments and remittance data. countries have already introduced comprehensive e-invoicing obligations for the B2B sector. Particularly noteworthy are:

ItalySince 2019, all companies have had to use electronic invoices.

Latin America: Countries like Brazil, Argentina and Mexico have been introducing e-invoicing regulations for years.

Asia: Countries like South Korea and India rely on e-invoices for B2B transactions.

Middle EastIn Saudi Arabia electronic B2B invoicing has been mandatory since the end of 2021. Also Egypt introduced an obligation for B2B invoices in 2021, which was extended to B2C invoices in 2022.

Australia and New Zealand: Australia is gradually introducing mandatory B2B invoicing from 2023 to 2025. New Zealand implemented changes in April 2023 to support e-invoicing and the adoption of the pan-European Peppol framework.

- ItalySince 2019, all companies have had to use electronic invoices.

- Latin America: Countries like Brazil, Argentina and Mexico have been introducing e-invoicing regulations for years.

- Asia: Countries like South Korea and India rely on e-invoices for B2B transactions.

Future: Countries with planned mandatory e-invoicing

While some countries already require electronic invoices in the B2B sector, others are planning to introduce them in the coming years:

- BelgiumCompanies must issue e-invoices from January 2026.

- Denmark: The obligation will be implemented in two phases by July 2026.

- PolandFrom February 2026, companies will have to use electronic invoices across the board.

- Germany and FranceHowever, both countries are planning to fully introduce mandatory e-invoicing by 2027.

Harmonisation of e-invoices a long way off?

The introduction of e-invoices is making varying degrees of progress around the world. Countries such as Italy and Brazil have already implemented comprehensive systems, while Germany and France are still working on their regulations. In the long term, however, the EU is aiming to harmonise requirements in order to facilitate cross-border trade. However, the systems remain inconsistent for the time being, as each country sets its own priorities and develops at different speeds.

For internationally operating companies, however, it remains essential to adapt to country-specific regulations at an early stage and adapt their systems in order to avoid legal risks and organise processes efficiently.

Service description in the e-invoice: How much detail really needs to be included?

Verifactu in Spain: the new invoicing obligation

The e-invoicing regulations in Europe

E-bill 2025 FAQs

Preparation for the introduction of CKS.EINVOICE

E-invoicing - The flexible EN 16931 standard

E-Invoice master data and settings in SAP Business One

Archiving of e-invoices

International e-invoices: differences and global developments