Before submitting a VAT return, one checks whether all the information is correct for tax purposes or whether there are accounting errors. The instrument for this is the turnover tax check.

In this process, the information in the advance VAT returns or in the VAT return is compared with the data in the annual financial statements. This validation is carried out for turnover tax and input tax. If there are discrepancies, there are most likely accounting errors that need to be corrected before the annual financial statements are submitted.

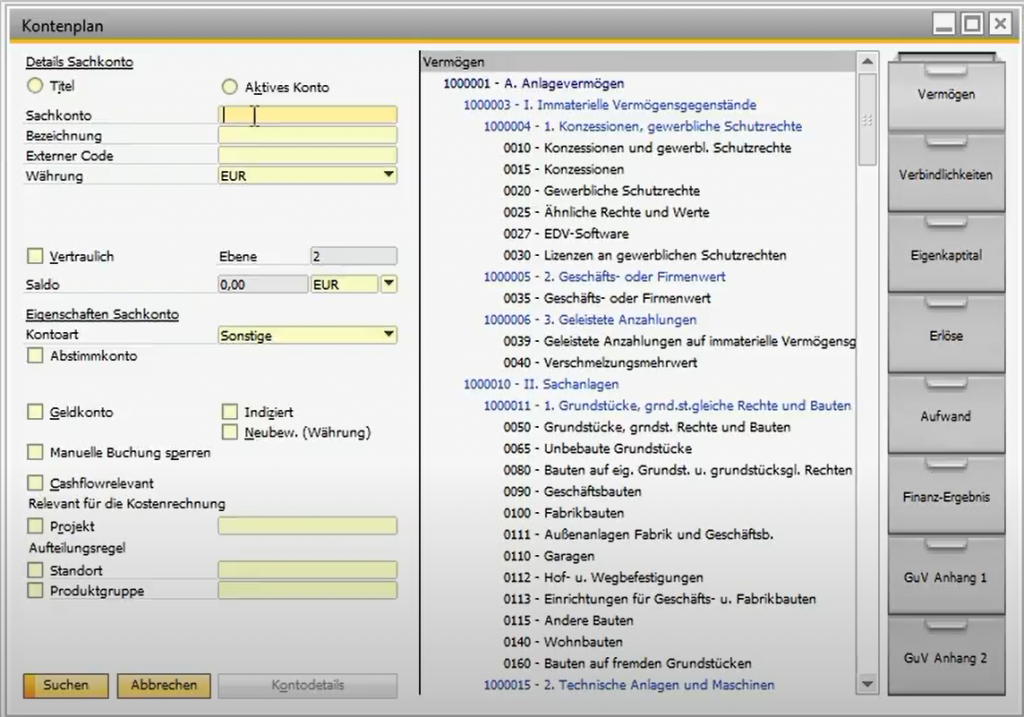

Finance in SAP Business One

Financial accounting in SAP Business One contains the entries that are required by law and enriches them with ...