In every medium-sized company, the management of open items plays a decisive role in the Liquidity and therefore for the financial stability of the company. Open items, i.e. invoices that have not yet been paid, can quickly lead to serious financial bottlenecks if not managed properly. But what are the best practices for managing open items and how can SAP Business One help to optimise them?

Payment behaviour is deteriorating

In 2023, the payment behaviour of German companies is approaching pre-pandemic levels, but payment practices continue to deteriorate. 79% of companies offer payment terms, but they demand their money faster, often within 30 days. The number of companies waiting for late payments rose to 76%. Industries such as automotive and transport are the most affected.

The impact of open items on liquidity

Punctual payments are crucial for the financial stability of a company. If customers do not pay their invoices on time, this can have a serious impact on liquidity. Medium-sized companies, which often have fewer financial buffers, are particularly affected. Payment delays can cause short-term bottlenecks and long-term financial difficulties. The following section takes a closer look at the impact of outstanding items on liquidity.

Short-term liquidity bottlenecks due to outstanding payment

If customers do not pay their invoices on time, this can lead to short-term liquidity bottlenecks. In such cases, the necessary cash is not available to cover ongoing costs and liabilities.

Endangerment of solvency

Persistent or frequent payment delays can jeopardise your company's solvency. This can lead to serious financial difficulties and, in extreme cases, insolvency.

Increased financing requirements due to open items

To compensate for these bottlenecks, companies may have to resort to short-term financing instruments such as overdraft facilities. These incur additional costs due to interest.

Impairment of working capital

Delays in payment tie up capital in open requirementsThis reduces the available working capital and restricts the financial flexibility of your company.

Domino effect due to outstanding payment

If your company itself falls into arrears, this can lead to a chain reaction and put a strain on your business relationships.

Increased administrative expenses

The need to send reminders to defaulting payers and follow up on receivables requires additional time and resources.

Best practices for the management of open items

Regular monitoring

Regular monitoring of open items helps to recognise potential payment delays at an early stage and take appropriate measures.

Use of suitable software

Modern accounting software, which is specifically designed for managing open items, automates many processes such as the posting of Incoming payments and the creation of reminders. This saves time and effort.

Effective dunning process

A structured Dunningwhich begins with friendly payment reminders can improve payment behaviour. However, companies should be careful not to jeopardise customer relationships.

Payment terms and discounts

Clear payment targets and the possibility of discounts for early payments can speed up the receipt of payments and improve liquidity.

Internal communication

Good collaboration between accounting and sales is essential. A centralised platform for all parties involved helps to avoid information asymmetries and increase efficiency.

Regular balance reconciliations

Regular reconciliations of account balances with bank transactions help to recognise and correct discrepancies at an early stage.

Maturity analysis (aging report)

Aging reports make it possible to monitor the maturity structure of open items and help to prioritise dunning measures and estimate liquidity requirements.

Using digitalisation to manage outstanding payments

Digital solutions for document processing and management increase efficiency and reduce manual errors.

Employee training

Ensure that employees are trained both professionally and technically to deal effectively with modern accounting systems.

Liquidity planning

The information from the management of open items should be used for precise liquidity planning and investment management.

Open items in SAP Business One

SAP Business One offers an efficient way to manage open items. With the "Open items" report, companies can filter and analyse their open items according to various criteria. This report can be exported in various formats such as Excel, PDF or CSV in order to further process or archive the data.

The Versino Financial Suite - More efficiency for open items and payment behaviour

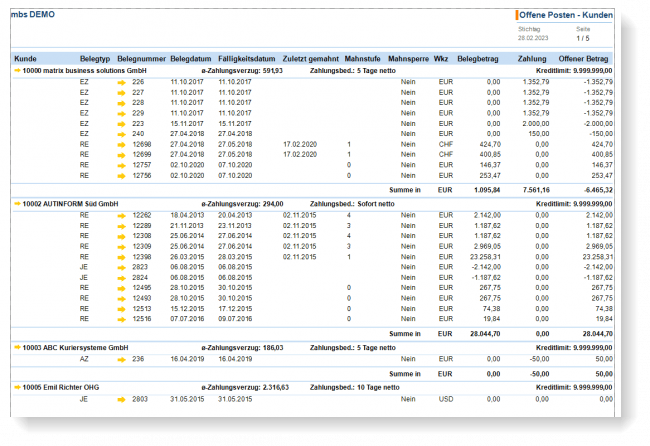

Open items customers" report

The "Customer open items" report of the Versino Financial Suite optimises and supplements the standard functions of SAP Business One. It provides an overview of all relevant information as at the reporting date, such as Dunning level and dunning date, as well as colour-coded blocked customers. The report also provides valuable insights into average payment arrears and agreed payment targets. This additional information enables payment processes to be organised more effectively.

Customer payment behaviour report

The "Financial Suite" offers another report that analyses the payment behaviour of customers quickly and easily. This function allows you to quickly analyse the payment behaviour of individual or all customers for one or more financial years and always provides a comprehensive overview.

The "Payment behaviour reports" category can be selected in the "Finance" module under the financial reports. The desired financial year is entered here, for example from 1 January to 30 September. It is possible to select the voucher status - open or closed - whereby closed vouchers are particularly relevant for the analysis.

The report shows the posting date, due date, invoice amount, payment amount and differences between the due date and payment date. For example, one invoice may have been paid five days before the due date, while others may have been paid 30 or 51 days after.

The print preview enables drill-downs to journal entries, business partners or individual invoices. Reports can be saved as PDFs and shared internally or externally.

Crucial financial stability and liquidity

Effective management of open items is crucial for a company's financial stability and liquidity. With the right strategies and tools such as the Versino Financial Suite, SMEs can manage their open items efficiently and thus ensure their financial flexibility and stability.

Service description in the e-invoice: How much detail really needs to be included?

Verifactu in Spain: the new invoicing obligation

The e-invoicing regulations in Europe

Versino Financial Suite V09.2025 for SAP Business One

Accounting outsourcing: Why it pays off for SMEs