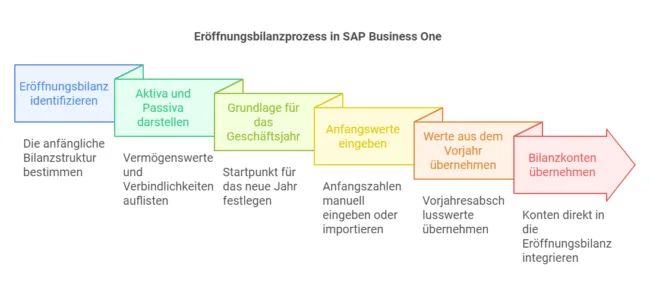

The opening balance sheet forms the basis for the financial accounting and is crucial for the accuracy of the financial data. Below are some key points of the opening balance sheet in "SAP Business One":

- Presentation of assets and liabilities: The opening balance sheet in "SAP Business One" lists all assets, liabilities and equity items of a company at the beginning of the financial year. It provides an overview of the company's financial situation at this point in time.

- Basis for the new financial year: The opening balance sheet serves as the starting point for all business transactions in the new financial year. Business year. All further bookings during the year are based on these initial values.

- Entering the initial values: When setting up a new company in "SAP Business One", the initial values of the various accounts must be entered manually or imported from a previous accounting system. These include cash balances, bank accounts, receivables and payables, Fixed assets and equity.

- Adoption from the previous year: For existing companies, "SAP Business One" automatically adopts the closing balance sheet from the previous year as the opening balance sheet for the new financial year.

- Balance sheet accounts and income statement accounts: While the balance sheet accounts (assets and liabilities) are transferred directly to the opening balance sheet, the income statement accounts (expenses and income) are closed via the income statement account and influence the equity in the opening balance sheet.

- Adjustments and corrections: Any corrections or adjustments required after the previous year's financial statements must be recognised in the opening balance sheet for the new year.

Creating and managing the opening balance sheet in "SAP Business One" requires care and accuracy to ensure that all financial data is correctly recorded and properly updated for the new financial year.

Payment advice in SAP Business One

In business, it is important to process payments quickly and efficiently. Payment advice notes play an important role in this. But what exactly ...

New features in SAP Business One 10.0 FP 2508

With the FP 2508 feature package for SAP Business One 10.0, SAP is clearly focussing on the web client - ...

Loan postings in SAP Business One

There is no specific module for managing loans and loan bookings in SAP Business One. Nevertheless, companies, especially ...

Credit management with SAP Business One - control meets consistency

Credit management initially sounds like a topic that only concerns banks - until you realise as a company that overdue receivables and ...

Accruals and deferrals in SAP Business One

The annual financial statements have their very own pitfalls. One of the most intriguing challenges is the timing of business transactions. Because anyone who thinks that expenses ...

Secure liquidity with SAP Business One

Liquidity is like the air we breathe - only when it becomes scarce do we realise how vital it is. Especially ...

SAP Business One web client - additional feature or strategic step

For a long time, the SAP Business One web client was regarded as additional - a tool for isolated use cases. However, with the current functional developments ...

Shopware 6 for SAP Business One

The Versino Shopware 6 interface for SAP Business One is a powerful solution for connecting Shopware and SAP Business One.

New features in SAP Business One 10.0 FP 2502

SAP Business One is constantly evolving to optimise workflows in medium-sized companies. With SAP Business One 10.0 ...

The cockpit of the Versino Financial Suite

The Financial Cockpit extends the financial management of SAP Business One. It has been specially developed to facilitate the management and analysis of ...

Finance in SAP Business One

The financial system in SAP Business One contains the entries that you are legally obliged to make and enriches them with ...