SAP Business One creates many journal entries automatically as part of the financial accounting integration during document entry. This can be illustrated using the example of an incoming invoice, where the "Origin" field refers to the document-related origin of the posting. The associated document, such as an invoice for a vehicle inspection, can be opened directly via a link arrow. In certain cases, this system document can also contain the original document as a file attachment.

Manual journal entries examples

Despite the automated posting processes, it is still necessary to make manual journal entries in certain situations. Typical examples of this are correction entries, annual accounts- or adjusting entries that become necessary as part of company audits, for example. Regular accounting transactions such as salary postings or cash movements are also often recorded manually.

Recording in SAP Business One

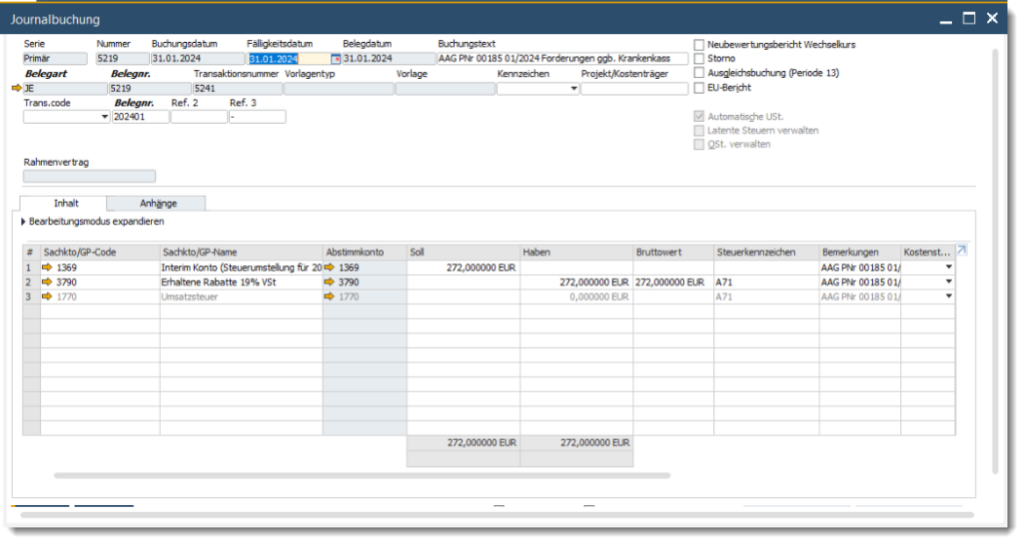

A manual journal entry is entered via the Financial Accounting module. The fields in the header area of the journal entry window apply to the entire entry and certain contents from this area, such as the entry text or the reference fields, are transferred to the entry lines as default values. The fields in the table area apply to the individual posting line. They can be customised individually.

Manual journal entry process

Manual journal entries may be necessary for many different reasons.

Let's assume you have accidentally posted an incoming invoice to the wrong expense account and need to correct it. As the posting period is already closed, it is not possible to re-enter the invoice. Instead, you create a manual posting to transfer the amount to the correct expense account.

The posting date and due date are defined when the posting is entered and the posting text is added. The "Adjustment posting period 13" option is used to separate the posting from the operational business transactions of the financial year and enables separate reporting in financial reports. The "Automatic VAT" function is activated by default, but must be deactivated for transfers to tax accounts.

After entering the posting lines, selecting the correct expense account and defining the correction amount, the posting can be added. It is important to note the definitive number of the journal entry and the abbreviation "JE" in the "Origin" field, which indicates a manual journal entry.

This approach illustrates how SAP Business One offers the flexibility to efficiently handle both automated and manual posting processes, enabling comprehensive financial management.

Service description in the e-invoice: How much detail really needs to be included?

Verifactu in Spain: the new invoicing obligation

The e-invoicing regulations in Europe

Versino Financial Suite V09.2025 for SAP Business One

Accounting outsourcing: Why it pays off for SMEs