base data

Before you can use SAP Business One bank processing, it is essential to have the necessary base data in the system. These form the basis for all further processes. From payment methods to banks and house banks - the careful maintenance of this data is crucial for the smooth processing of your financial transactions. Additional information is also required for your subsequent processing of account statements.

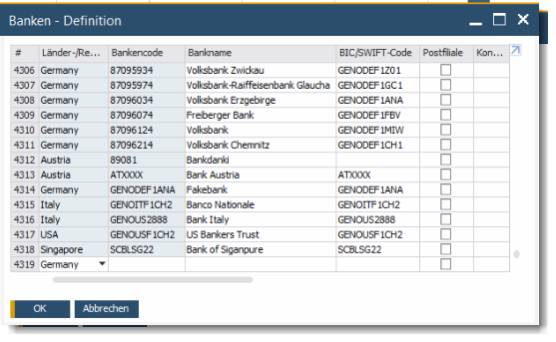

Invest in banks

The administration of this data includes the definition of your banks, the assignment of house banks and the maintenance of your business partners' bank details. Before you can use a bank in these roles, it is necessary to check whether it is already defined in the system. If this is not the case, you will need to create a new bank and enter information such as country, bank code, bank name and BIC/SWIFT code.

Define house bank accounts

Your house bank accounts are set up in the "House bank accounts" window under Administration. Specific details are required for each bank account, including the sort code (BLZ), branch, account number, template name, next higher cheque number and the BIC/SWIFT code. It is essential to maintain a separate bookkeeping account for each bank account to ensure accurate reconciliation and avoid complications that arise when multiple bank accounts are posted to one bookkeeping account.

The assignment of bank details to business partners

In addition to defining banks in SAP Business One Bank Processing and setting up house bank accounts, the assignment of bank details to your business partners is also a necessary step. This assignment makes it possible to execute payment instructions precisely and efficiently. The definition of the bank from which or to which own bank the individual business partner is paid is made in the "Business partner master data" window on the "Payment run" tab.

Manual payments: Incoming and outgoing payments in SAP Business One

SAP Business One allows you to post manual incoming and outgoing payments. This can be useful for a wide range of transactions. These include bank account statements or cash register transactions. However, it is important to note that although manual journal entries are possible, they can interrupt the seamless document chain. SAP Business One therefore classifies incoming and outgoing payments into separate document types, which is an advantage in many areas and enables invoices to be integrated upon payment.

Selecting the payment method in SAP Business One bank processing

Finally, you have the choice of payment method in the banking process. SAP Business One offers an intuitive interface for this, where you can choose between cheque, bank transfer, credit card or cash payment. Each method requires you to enter specific data, such as cheque information or credit card details. The choice of G/L account also plays a role and can be customised based on the G/L account determinationand adjusted if necessary.

Service description in the e-invoice: How much detail really needs to be included?

Verifactu in Spain: the new invoicing obligation

The e-invoicing regulations in Europe

Versino Financial Suite V09.2025 for SAP Business One

Accounting outsourcing: Why it pays off for SMEs