In SAP Business One, you can use depreciation areas to determine the value of your Fixed assets for different purposes. Individual depreciation methods can be defined for each depreciation area. For example, you can set up one depreciation area for commercial depreciation and another for tax depreciation.

Important aspects of the assessment areas

Types of assessment areas

- Main assessment areaDepreciation is posted directly to the G/L accounts in the general ledger.

- Additional assessment area: For reporting requirements, such as the presentation of asset values according to IFRS.

- Derived valuation rangeValues are taken from a main depreciation area, e.g. to show depreciation without special depreciation.

Definition of the assessment areas

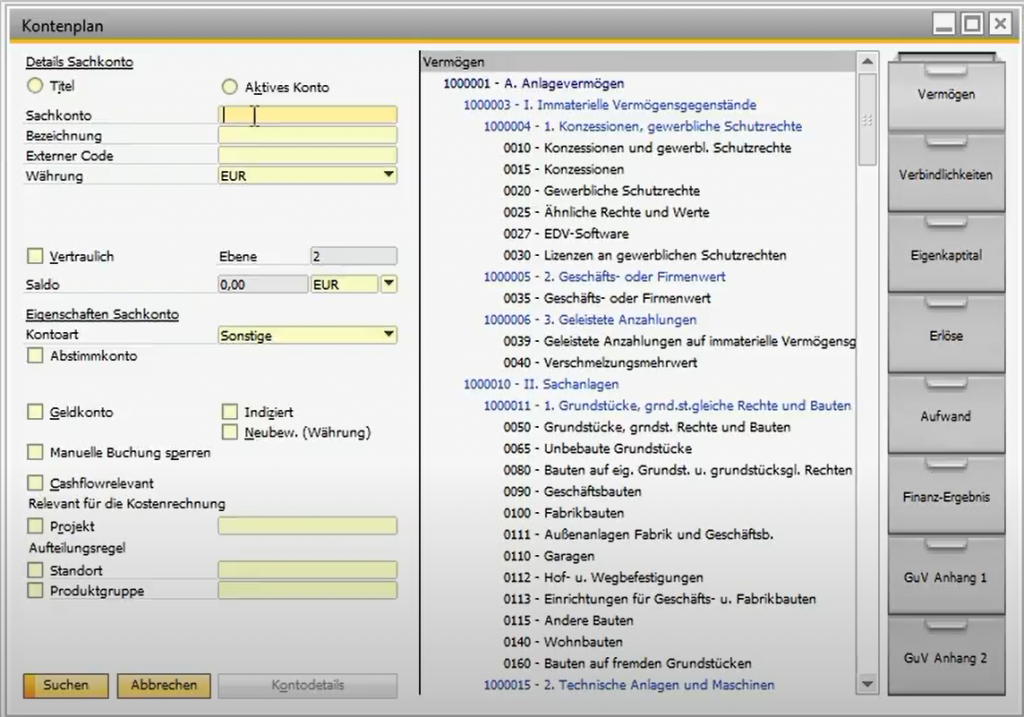

You can select valuation areas in the menu path Administration > Definition > Financial accounting > Asset accounting > Depreciation areas create. Enter the following information:

- A code

- A description

- The type of assessment area

Allocation to asset classes

Assessment areas can be assigned to several asset classes They then apply to all systems in the respective class.

Amortisation methods

A specific amortisation method that meets the individual requirements can be defined for each valuation area.

Display of depreciation details

In the Plant master data you can view and analyse the depreciation details for each depreciation area.

Finance in SAP Business One

The financial system in SAP Business One contains the entries that you are legally obliged to make and enriches them with ...

Verifactu in Spain: the new invoicing obligation

The e-invoicing regulations in Europe

Versino Financial Suite V09.2025 for SAP Business One

Accounting outsourcing: Why it pays off for SMEs

CANDIS for SAP Business One