Accruals and deferrals are an important concept in the financial accountingwhich enables the correct allocation of income and expenses over time. It is based on the principle of accrual accounting, according to which income and expenses are recognised in the period in which they are economically generated, regardless of the time of payment.

There are two main types of prepaid expenses:

Prepaid expenses and deferred charges (ARAP): These are expenses that were incurred in the current period but represent a benefit for future periods. For example, if an insurance premium is paid in advance in December for the entire following year, the portion of the premium relating to the new year is treated as prepaid expenses and recognised as an asset in the balance sheet.

Deferred income (PRAP): This is revenue received in the current period but relates to services that will not be provided until later periods. For example, if a company receives a payment in December for services that it will provide in the following year, this part of the income is recognised as deferred income (PRAP) in the balance sheet as a liability. Liability recognised.

For SAP Business One, the Versino Financial Suite automation and simplification of the accruals and deferrals process.

Purchasing documents in SAP Business One - consistently efficient

Budgets in project-related purchasing with MariProject

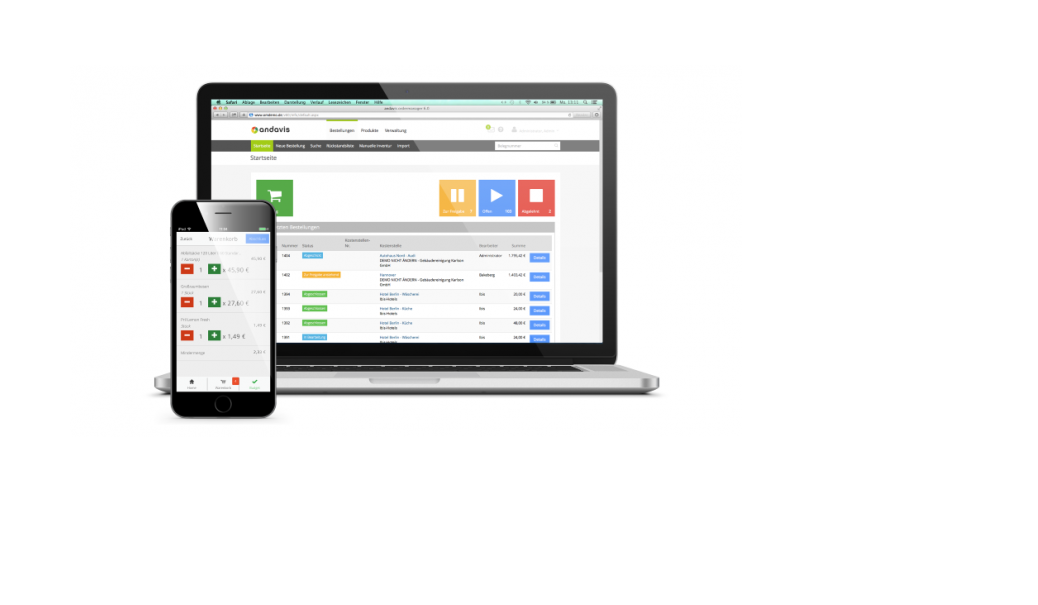

Purchasing like "the big boys" in SAP Business One with andavis ordermanager

Preparation for the introduction of CKS.EINVOICE

Moving average price in SAP Business One