Netting and creditors with debit balances are two concepts used in finance to offset debts and receivables between companies. We will look at when this makes sense and what makes them different.

What is netting in financial accounting

Netting is a sometimes complex process used by companies or financial institutions to simplify and minimise payment flows. Essentially, the process enables the reduction of payments that need to be exchanged between two or more parties. The aim of the process is to reduce these to a single payment.

The receivables and liabilities existing between the parties are offset against each other. The software calculates the net amount that each party has to pay. This optimises transactions and saves time and costs.

Example of netting in the Group

Assume that subsidiary A regularly provides services to subsidiary B, while B supplies A with goods in return. By applying netting, the mutual receivables and liabilities can be offset so that only the balance is recognised as a payment.

Types of netting

There are different types of netting procedures. There is bilateral, multilateral and cross-border netting, which can be used depending on the area of application and the parties involved. Bilateral netting is carried out between two parties, while multilateral netting involves several parties. Cross-border netting, on the other hand, is used when the parties involved are based in different countries.

In practice, netting is often used by companies that operate in different countries and regularly make payments between different countries. Subsidiaries. settle. Netting is also widespread in the banking sector and is used to optimise payment flows and minimise default risk.

Accounts payable in financial accounting

The term "creditors with debit balances" refers to the circumstance that sometimes occurs when a business partner of a company is both its customer and its supplier. This means that the company is both the creditor and debtor of its business partner. This results in a double receivable and liability between the two parties.

The company has a receivable from its business partner for goods or services it has supplied, but it also owes the business partner money for goods or services supplied by its business partner. The management of these dual receivables and payables requires a high degree of care and accuracy, as it can have a direct impact on the company's liquidity.

Special accounts for creditors with debit balances

To closely monitor accounts payable, companies often use accounts that have been set up specifically for this purpose. These accounts allow outstanding receivables and payables to be tracked and managed separately for each customer. It therefore helps that companies carefully monitor and manage their accounts payable to ensure their liquidity.

Netting with the Versino Financial Suite for SAP Business One

The netting function within the Versino Financial Suite enables you to carry out automatic offsetting of debtors and creditors in SAP Business One. This involves a business partner who has a receivable from another business partner, but also a payable to the same party. The automated comparison of offsettable receivables and payables ultimately generates a net balance, which enables you to effectively optimise your liquidity and avoid unnecessary transfers.

Overview of both sides

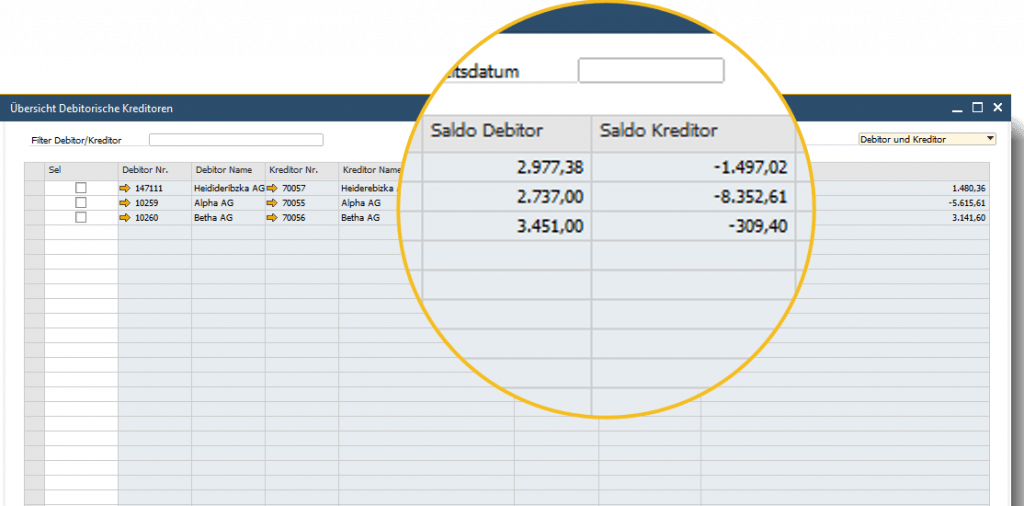

The Versino Financial Suite's approach is to first provide an overview. This allows you to see which linked business partners currently have a balance. In this overview, the customer and vendor numbers, the current balance of both and the resulting difference are displayed.

Semi-automatic tuning

It is possible to analyse the balances of the linked business partners in more detail. The current debit and credit balances can be displayed by double-clicking on a business partner. A semi-automatic reconciliation can be carried out here, in which I decide myself which debit invoice should be offset against which credit invoice

Automatic tuning

Another frequently used method is automatic and global tuning. This involves selecting the desired constellation and pressing the button for global tuning. The following then happens in the background: An incoming payment is posted for each of the open customer invoices, an outgoing payment is posted for the open supplier invoices and the resulting difference is recorded as a journal entry. If we then look at the journal entries again, the last entry created is precisely this difference entry.

Integration with the SAP Business One payment wizard

After reconciliation, we have cleared the customer's balance and the corresponding difference remains with the vendor. When we then run the payment wizard in SAP Business One, this difference posting is proposed for payment. The software then generates the SEPA file from this.

Payment advice note for the supplier

As the supplier cannot do much with the amount at first, we have developed a special report and payment advice note. You can find this report in our report package.

With this report, we can show the business partner in detail how the payment amount that is expected to arrive on their account on the next working day is made up of the various receivables and payables. On the supplier's account statement, the reference "See payment notification of the corresponding processing date" is then indicated. In this way, the supplier can see how the amount is made up and post the payment accordingly in their system. This mapping functionality, i.e. the allocation and display of the various payment elements, enables transparent and efficient processing and communication with business partners.

Versino Financial Suite V09.2025 for SAP Business One

Accounting outsourcing: Why it pays off for SMEs

CANDIS for SAP Business One

Convert SAP Business One to camt.053 now

Loan postings in SAP Business One