In the area of the Finance continuous inventory management in SAP Business One is a decision in favour of inventory management with far-reaching consequences. SAP B1, which is characterised by a wide range of functions in the area of financial accounting, also offers specific mechanisms for continuous and non-continuous inventory management. This article looks at how these processes are implemented in SAP Business One and what impact they can have on the work of financial accountants.

Inventory valuation methods in SAP Business One

In SAP Business One you can choose between three different methods for inventory valuation: Standard Price, FIFO (First-In-First-Out) and GLD (Moving Average). Each of these methods has its own characteristics and is therefore suitable for different business scenarios.

Standard price: Consistency in controlling

With the standard price as the valuation method, you set a fixed price for a specific time period. All goods movements of an item are constantly valued at the same price during this time period. The clear advantage of this method is the possibility of consistent controlling of the production process.

FIFO: Ideal for seasonal goods

FIFO stands for First-In-First-Out. With this valuation method, each purchase price is accounted for individually. When a sale takes place, the oldest purchase price is used. In this respect, this method is particularly suitable for companies that trade in seasonal goods, as here the oldest stocks are reduced first.

Moving average (GLD): Flexibility in case of price deviations

The moving average (GLD) calculates a new average material price after each goods receipt and invoice receipt. This means that in the event of deviations in material receipts, for example in production, the subsequent material issues are valued with a more up-to-date price. This method offers flexibility and can be particularly advantageous in dynamic market environments.

Continuous inventory management and its advantages in SAP Business One

So what are the differences and thus the effects of the inventory management variants in SAP Business One? In perpetual inventory, inventory entries are reflected in the form of financial transactions in the financial accounting system. With this method, inventory postings thus affect both stock levels and stock value, and in the general ledger, automatic journal entries created for the changes in inventory value.

Calculation of gross profit: Continuous and non-continuous inventory management

By using perpetual inventory, SAP Business One calculates an item price for each stock item. Based on this item price, the gross profit of each item can be calculated. A/R Invoice can be determined. If perpetual inventory is not active, the gross profit can be calculated on the basis of price lists or the last determined purchase price.

Allocation of material costs according to cause

The use of perpetual inventory management ensures that material costs are allocated according to their origin. Stock movements have a direct impact on both the physical stock quantity and the stock value. As part of this system, postings are automatically made to the general ledger in order to keep both the stock level and the stock value up to date. The prerequisite for this is that the postings for the goods receipt and the associated incoming payments are made promptly.

Special stock account

Purchases of items that fall under inventory management are recorded in a special inventory account. The expense for these materials is recognised in the accounting system as soon as the items leave the warehouse to be delivered to customers or when they are consumed in production. An offsetting entry is made to the previously debited stock account to reduce the number of items delivered or consumed. Triggers for these postings can be the actual delivery or the issuing of an outgoing invoice, even if there is no prior delivery documentation, as well as the withdrawal of materials for the production process, whether by retroactive accounting or manually.

Disciplined accounting necessary

The efficient utilisation of continuous inventory management requires disciplined accounting. In particular, it is important that goods receipts and the corresponding invoices are posted without unnecessary delays in accordance with the business model. This enables items to be correctly valued in the SAP Business One system. If invoices are only posted after the corresponding items have been sold and the actual purchase price differs from the originally posted price, SAP Business One automatically makes an adjustment posting. This ensures correct accounting and valuation recording. However, the frequent need for such corrections can increase the complexity of accounting and thus the effort required to track and check the postings. Similar challenges arise with negative balances, which are possible but not recommended for reasons of accounting clarity and simplicity.

Decision criteria for inventory management in SAP Business One

Continuous and non-continuous inventory management in SAP Business One provide different mechanisms for recording and valuing inventory changes. The choice between these methods and the associated accounting discipline thus have a direct impact on the accuracy of inventory valuation, the calculation of the Gross profit and the traceability of postings. Careful consideration of the advantages and disadvantages of each method and, if necessary, consultation with a tax advisor are essential in order to fully utilise the advantages of each inventory management method.

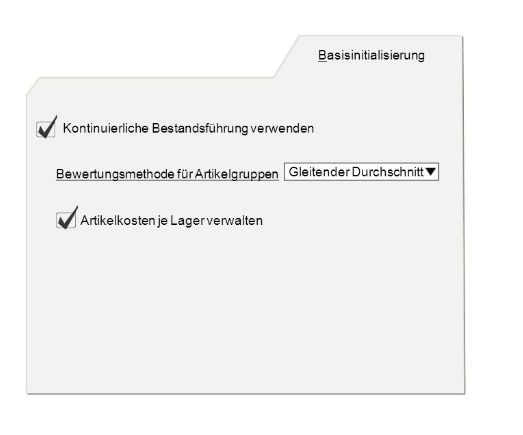

Please note: You must activate continuous inventory management before carrying out the first inventory transaction. As soon as the first stock transaction has been registered, the option to choose between continuous and non-continuous stock management is deactivated. This setting cannot be changed at a later date.

Elster 2025 for SAP Business One

The advantages of the e-bill 2025

Financial accounting 2025 - information & changes

Posting periods in SAP Business One

E-bill master data and settings in SAP Business One