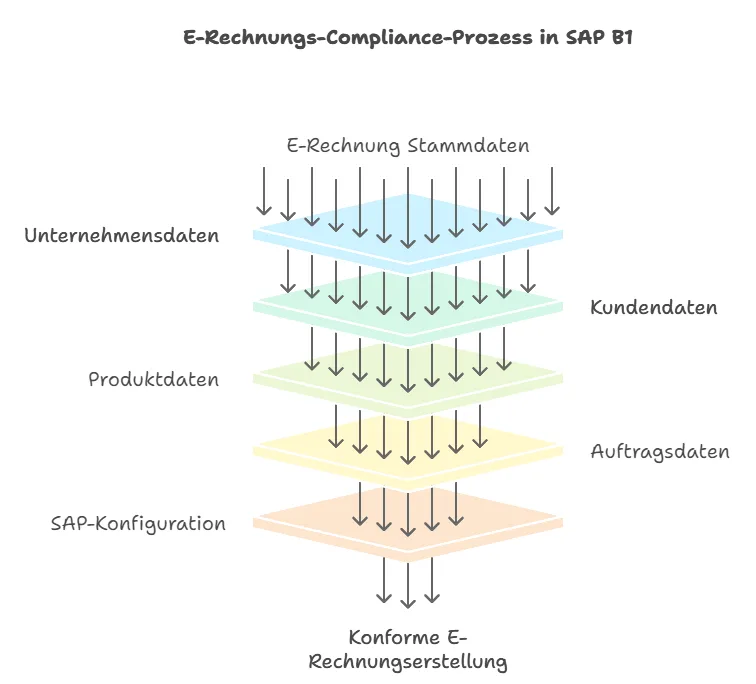

To ensure compliant e-invoices in the XInvoice- or ZUGFeRD-format, an ERP system requires certain correctly maintained master data. Special settings in the SAP system are also necessary in order to fulfil the legal requirements efficiently and ensure smooth processing.

Required e-bill master data

Company, customer, product and order-related data form the basis for the creation of a legally compliant e-invoice. Only with correct and complete information can electronic invoices be generated and processed without additional effort. The most important master data at a glance:

Company data:

- Full name and address of the invoicing party

- Tax number or VAT identification number

- Commercial register number or other registration numbers

- Bank details

Customer data:

- Full name and address of the invoice recipient

- Customer number or alternative unique identifier

- Sales tax identification number of the customer (if available)

- Routing ID for invoices to public clients

Product data:

- Unique article numbers and designations

- Unit prices and units of measure

- Applicable tax rates

Order-related data:

- Order number or contract number

- Delivery note number

- Performance period or delivery date

Necessary settings in SAP Business One for XRechnung

Specific configurations are required in SAP Business One so that the e-invoices comply with the legal requirements and the system can process them correctly. Please note the following key details:

- document numberingA separate number series for electronic documents must be defined and activated for all relevant document types such as invoices and credit notes?

- Business partner baseThe electronic voucher ID and the VAT structure (9930 for Germany) should be maintained in the business partner master data. In addition, an invoice and delivery address as well as the IBAN number for payments must be stored. Optionally, an e-mail address can also be defined for sending electronic receipts if no PEPPOL protocol is used?

- Set export pathAn export path is required for the export of XML documents, which is defined in the general SAP settings and in the settings for electronic documents. The authorisations for this path must grant write and read access?

- Protocol selection and certificatesSAP offers a choice for XInvoices between the PEPPOL- and a generic protocol. The configuration of the appropriate protocol and a corresponding certificate for the electronic signature increase the security of the documents?

- Company detailsThe relevant company details, including VAT number, company tax number and contact information, must be maintained in the company details, as they are used in the XML structure of the XRechnung as "Accounting Supplier Party"?

- Article master data and units of measure: For the PEPPOL format article numbers and units of measure must be clearly defined. SAP offers the option of storing standardised code lists (e.g. GTIN) for article numbers and units of measure so that the requirements for classifications and units of measure can be met.

Data quality and management

Maintaining the e-invoice master data has a direct influence on the quality of the e-invoices generated. Regular data maintenance, validation mechanisms and targeted training ensure reliable invoicing.

- Regular master data maintenanceAll data must be constantly checked for up-to-dateness and accuracy in order not to jeopardise invoicing.

- Validation mechanismsAutomated checking mechanisms ensure that the data quality meets the requirements and that errors are recognised at an early stage.

- Employee trainingA basic understanding of the required data and its importance is essential in order to minimise errors in day-to-day work.

E-bill 2025 FAQs

Preparation for the introduction of CKS.EINVOICE

E-invoicing - The flexible EN 16931 standard

E-bill master data and settings in SAP Business One

Archiving of e-invoices

International e-invoices: differences and global developments

MariProject / Tool for e-invoicing

cks.eINVOICE -Addon for XRechnung & ZUGFeRD

E-invoicing for SAP Business One