All companies today have to take into account the GoBD-compliant storage of certain documents. Correct archiving alone is not enough. A procedural documentation must record which measures and procedures are to be taken in concrete terms.

Entrepreneurs should expect that the tax office will demand documented procedures at the latest during the next tax audit. Among other things, they must describe in a procedure documentation how the company ensures the GoBD-compliant storage of documents that are relevant for the tax authorities.

GoBD-compliant archiving

The GoBD describes how you are to be informed of the software-supported accounting comply with the principles of good accounting under tax law. Principles of proper accounting have been defined for a long time: According to these, primarily all business transactions should be complete, correct, documented, recorded and archived. This must be done quickly and in an orderly manner. Nothing may be forgotten or lost and it must be ensured that the documents are traceable and unchangeable.

through the digitalization accounting, receipts and other business documents are no longer stored in files. A digital archive is probably the more modern way to do this. However, such storage of documents must fulfil all GoBD requirements. For example, documents must be protected in such a way that they cannot be deleted or manipulated. Moreover, they must always be clearly related to a business transaction. This type of audit security must be verifiable.

What is part of the procedural documentation?

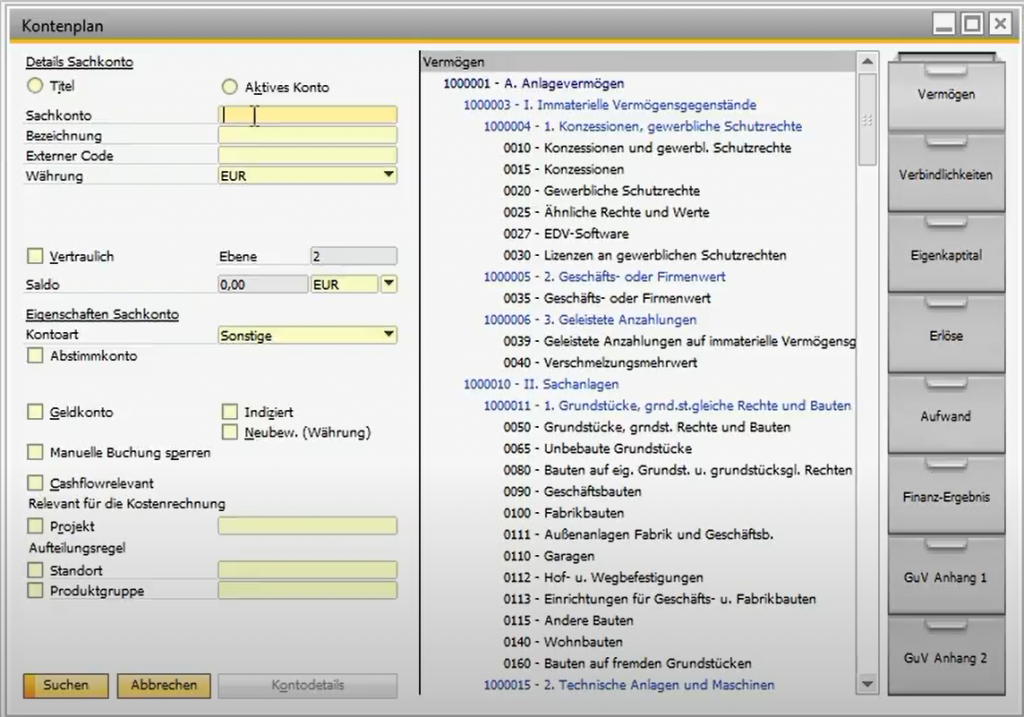

How can you have a ?Audit-compliant archiving? describe in the process documentation? A company can implement audit-proof archiving using a document management system (DMS). The software, its metrics and technology are then described in the process documentation. This protocol covers all processes, responsibilities and system settings that serve to fulfil the GoBD criteria.

Business software as a prerequisite for procedural documentation

Business software with integrated financial accounting records all processes, business transactions and system settings in the background. In combination with digital document management, a high level of GoBD-compliant archiving is achieved. The software package should log all accesses and changes with a time stamp. The more areas of the company are mapped by the business software, the more documents to be archived are recorded by the solution. Everything that takes place outside of the company must of course also be recorded, as long as it is in the context of the GoBD.

Why the procedural documentation

If there is an external audit, the auditor must be able to get an overview of a company's finances within a reasonable amount of time and effort. The figures alone are not enough. The auditor also wants to know how the figures are arrived at. A procedural documentation provides such information and also makes it comprehensible which precautions have been taken to prevent manipulation.

The general description

The general description contains the basics, functions and areas of application of the accounting system. This includes information on which tasks are carried out by the company itself and which are outsourced to service providers. It is also stated here whether software is used in the cloud or on-premises uses.

The user documentation

They explain the different application modules and data entry fields as well as the internal processing procedures - such as booking rules - and the settings and regulations in the software that are specific to your company. Technical processes such as data entry, verification, reconciliation, output, inventory of data and documents and deadlines are also part of the user documentation.

Operating documentation

The operational documentation should describe the elements of the internal control system, the IT controls and the technical and organisational measures (TOMs) put in place to ensure the accuracy and security of your accounting processes, e.g. : Data backup procedures, access controls, user rights, roles, competencies, programme change approval procedures and change management procedures.

The technical system documentation

This part of the procedural documentation covers all components of the system and their interfaces. It describes the interactions between the different system components. Further, it contains a description of the internal processing rules of the software from a technical point of view (e.g. data flow diagrams, flow charts and protocols). This part of the documentation also includes error handling procedures and details of the data model. This allows tax administrations to understand how functions and controls are implemented in the software.

Archiving of e-invoices

MariProject / Tool for e-invoicing

cks.eINVOICE -Addon for XRechnung & ZUGFeRD

GOBD and GOBD myths

E-invoicing for SAP Business One

PEPPOL integration in SAP Business One