What exactly is a VAT advance return?

In principle, the sales tax return is a control function for taxpayers and the tax office. Sales tax is also an annual tax, for which a sales tax return must be submitted in the following year. That ELSTER system then offsets the previous sales tax payments.

If you have declared and paid all VAT on time (i.e. quarterly or monthly), there will be no "payment burden" in the VAT return. However, if too much VAT has been paid, this will also be refunded. The same applies to advance income tax payments.

When do I need to register?

It's the small differences that make the difference: freelancers and entrepreneurs have until January 10th, April 10th, July 10th or October 10th, in the previous year between 1,000.01 and 7,500 euros sales tax have paid their sales tax return. Is there a company above this amount, is pre-registered on the 10th of each month. lie down below value, the tax office exempts you from the Pre-registration exempt. However, the annual declaration remains.

- As a VAT payer, you have a three-day grace period. The late payment surcharge only applies from the 14th day.As a VAT payer, you have a three-day grace period. The late payment surcharge only applies from the 14th day.

- After setting up a company, you must submit a pre-registration to the tax office for the first year and the following year.

- However, small businesses (with a turnover of less than 17,500 euros) do not have to register in advance.

Extra: Permanent extension

If 10 days is too short for you for a reliable accounting you can also apply for a one-month extension of the deadline. However, if you have a monthly sales tax liability, you must pay 1/11 of the previous year's total of your tax to receive it. Billing is always done at the end of the year.

How to pre-register?

Tax returns are normally submitted via the ELSTER system. You will need at least one certificate for your computer. This can simply be requested from the tax office - and is also set up by them. Then "simply" submit the form regularly with base data Fill in and then determine the sales tax.

Because that's not always easy, here Step by step:

Line 81This is where you enter the sales for 19% VAT (net).

Line 86: If you have to pay 7 % VAT, here are the net sales. This also applies to sales from triangular transactions.

Line 66: The input tax amounts paid are entered here. ONLY the tax amount, not the net turnover.

Here's an example: Revenue: 1,190 euros (1,000 euros net + 19% sales tax) Expenditure: 83.30 euros (70 euros net +19% sales tax) Line 81: 1,000 euros (net value) Line 66: 13.30 euros (19% sales tax value)

Line 83: ELSTER will now display the VAT to be paid here. Please check for plausibility and then submit using "Submit tax return to the tax office" (password required for certificate).

..Important afterwards! Save the file for your own records and to print out.

Now all you have to do is pay the advance VAT return and you're done.

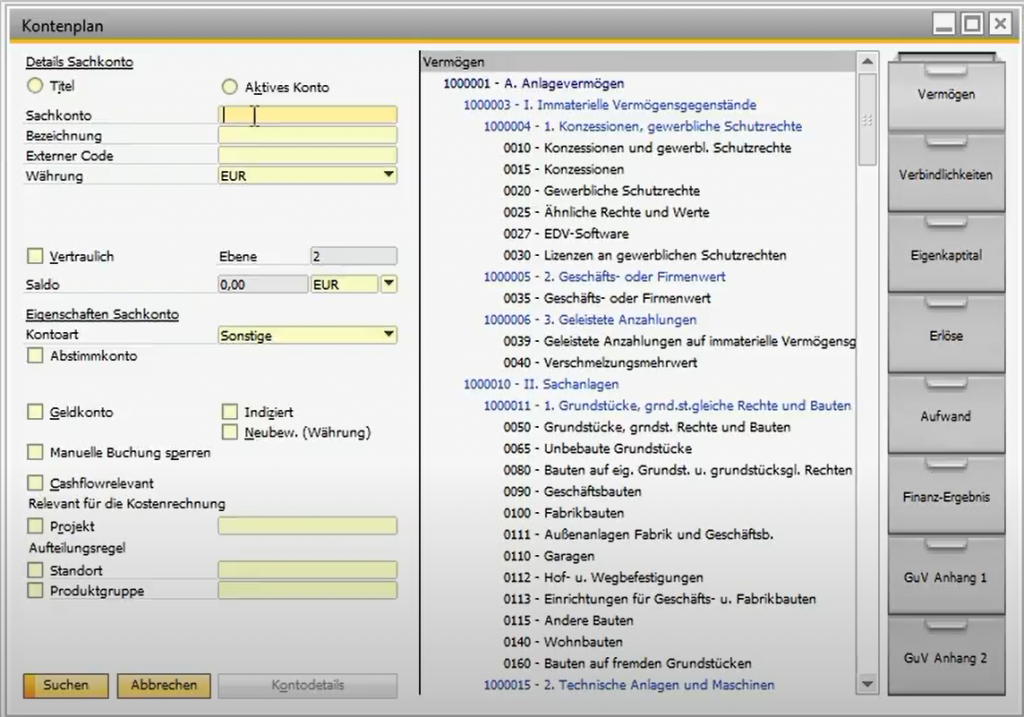

Add-On: ELSTER for SAP Business One

The Elster add-on for electronic filing of the advance return is included as standard with SAP Business One. Continuously updated certifications ensure approval and legal certainty for companies. Even country-specific allocation rules or notifications can be taken into account and reported accordingly thanks to the flawless functioning of the installation. The VAT calculation is then automatically applied to each component of the transactions for the period. In this way, businesses can submit their monthly (or quarterly) Elster VAT return online and at the same time submit the VAT report for their own purposes.

Finance in SAP Business One

Posting periods in SAP Business One

E-bill master data and settings in SAP Business One

Moving average price in SAP Business One

SAP Business One - Open items

GOBD and GOBD myths