There are small but significant differences between a progress bill and a partial bill. Companies must therefore be careful when handling these types of invoices. Especially in sectors such as the plant construction or the construction industry are affected. Good when a Software supported in this.

The partial invoice

The colloquial term "partial invoice" strictly speaking stands for the more correct term "partial final invoice". This refers to the proper Accounting one or more services that have already been provided in full. With regard to the consequences for the financial accounting So the partial invoice does not behave any differently than a complete final invoice. Accordingly, this also applies to the warranty obligations.

The partial invoice

On the other hand, the partial invoice, which is often used in the construction industry or plant construction, often contains a percentage of the services to be charged for a completed work or project. At the same time, this partial invoice, in contrast to the partial invoice, does not refer to explicit services or project phases. For example, the client of a system has to pay 30 % of the budget before the start of construction, which is requested via an advance invoice. First of all, unlike the partial invoice, the type of invoicing does not affect the warranty periods.

Correctly tax the partial invoice and partial invoice

From a tax point of view, different rules apply to the two types of invoice. In principle, there is an obligation to remove the value added tax at the end of the pre-registration period in which the company provided the service. This applies to partial invoices and to final bills. However, if the contractor prepares a partial invoice, the sales tax is already due at the end of the pre-registration period in which the partial payment was received.

Correct final calculation

If an entire project is completed, all services must also be invoiced with a final invoice. The project thus becomes "profit-effective". All advance payments for the completed work must be included in this invoice. This deposits naturally reduce the final payment.

Correct billing with MariProject

Flexible billing

MariProject helps you sustainably with the various types of billing in the project business. Partial and installment invoices, requests for payment, at cost or at a fixed price.

Assets under construction / work in progress (WIP)

MariProject can determine the value of your assets and projects using various methods. Examples are ?Percentage of Completion? or ?earned value?. The values determined in this way are immediately posted correctly via the integrated financial accounting.

Billing for maintenance & repairs

MariProject also calculates the regular and irregular performance from maintenance and service of your systems and projects.

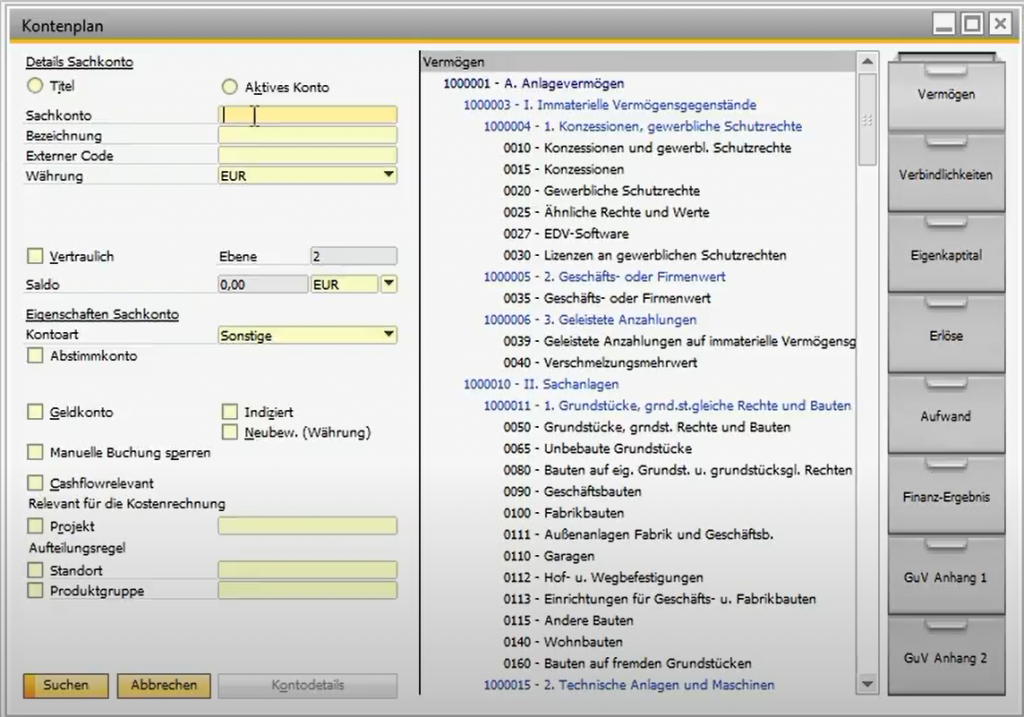

Integrated financial accounting

SAP Business One's integrated financial accounting records all invoices and invoice types factually and fiscally correctly.

Posting periods in SAP Business One

E-bill master data and settings in SAP Business One

Moving average price in SAP Business One

SAP Business One - Open items

GOBD and GOBD myths

IFRS & HGB with SAP Business One