Electronic invoicing is no longer a topic for the future, but is becoming a legal requirement in many European countries. Driven by initiatives such as ViDA (VAT in the Digital Age) of the EU, a patchwork of national regulations with an increasingly binding character is emerging. For companies - especially SMEs - this means that the transition from paper-based or PDF invoices to structured, machine-readable invoices is becoming increasingly complex. E-invoices is no longer optional, but a regulatory necessity

1. the transition to the digital invoice in Europe

1.1 The overarching framework: ViDA as a driving force

The Europe-wide introduction of electronic invoicing (e-invoicing) is not happening by chance, but is based on a clear strategic direction: „VAT in the Digital Age“ (ViDA) as an initiative of the European Union. The aim of this measure is to fundamentally modernise the VAT system within the EU and at the same time eliminate key weaknesses. In particular, this includes the so-called Value added tax gap . This refers to the difference between estimated and actual VAT amounts collected. In 2020, this amounted to around 99 billion euros across the EU. ViDA aims to combat VAT fraud more effectively, increase transparency and drive forward the digital transformation of tax collection. At the same time, the initiative creates the regulatory framework for standardised and mandatory e-invoicing procedures in all member states.

1.2 The central challenge: A harmonised goal, but fragmented paths

ViDA has a clear objective: the gradual harmonisation of electronic invoicing in Europe. This has a major impact on cross-border B2B-area by 2030 is of particular importance. At the same time, however, the initiative allows member states to independently introduce or accelerate national regulations for mandatory e-invoicing in domestic business transactions. This results in a complex area of tension. Because while the final state is intended to be standardised, the paths to it are taking place at different speeds and with different structures.

This means for internationally active companies: They have to adapt to numerous national requirements at the same time, which can differ considerably in terms of technical formats, transmission channels and schedules. The operational implementation of this regulatory diversity is currently the biggest challenge. This is particularly true with regard to system architecture, process design and compliance.

The following sections analyse the technological similarities that form the framework for interoperable e-invoicing on the one hand, and the key differences in the national implementation models on the other, which contribute significantly to the existing complexity.

2. the common technological foundations

2.1 EN 16931: The common language of the e-invoice

The European standard EN 16931 defines a standardised semantic data model for electronic invoices. It specifies which structured information an e-invoice must contain so that it can be correctly interpreted and automatically processed across national borders. EN 16931 thus forms the technical reference for almost all national e-invoicing mandates within the EU.

In practice, however, it is clear that although the standard creates a standardised basis, there is still scope for national adaptations. These take place via so-called Core Invoice Usage Specifications (CIUS), the country-specific profiling of the standard. A CIUS can introduce additional data fields or make existing elements more restrictive in order to fulfil country-specific requirements.

Examples of this are the XInvoice in Germany or the FatturaPA in Italy. These are both variants based on EN 16931, but differ from each other. This diversity of variants is the main reason for the technical fragmentation within the EU.

For companies, this means that a centralised „standard template“ based on EN 16931 is not enough. Rather, ERP systems must be able to create a standardised template for each target country. valid, CIUS-compliant XML files that comply with the respective national validation rules.

2.2 The PEPPOL network: the de facto standard for exchange

Whilst EN 16931 defined, which The content of an e-bill is regulated by the PEPPOL network (Pan-European Public Procurement Online), like these invoices are transmitted in a secure and standardised manner. This is not a centralised platform, but an interoperable framework of technical specifications, governance rules and certified service providers.

The central principle is the so-called Four-corner model, which enables structured and scalable communication between sender and receiver:

- Corner 1 - Sender: A company generates the e-invoice in its ERP or accounting system.

- Corner 2 - Access point of the sender: The invoice is sent to the PEPPOL-certified access point of the sender.

- Corner 3 - Access point of the receiver: The recipient's access point accepts the message from the PEPPOL network.

- Corner 4 - Receiver: The invoice is electronically integrated into the recipient's system and processed further.

The great advantage of this model lies in its scalabilityCompanies only need to establish a single connection to a certified access point. They can use this access to communicate with all other PEPPOL participants - regardless of the partner's location or system used.

Despite this standardised technological basis, there are major differences in practice. This is due in particular to national procedural requirements, responsibilities and implementation models.

3. a comparison of the process models: the decisive difference

The choice of process model determines the extent to which the state intervenes in the invoicing process and, moreover, which control mechanisms it establishes. There is a wide range, from purely retrospective checks to the approval of each individual invoice by a government platform.

| Model | description | Degree of state control | Example countries |

| Centralised Clearance (CTC) | Invoices must before or during The data must be validated by a centralised government platform before dispatch to the buyer. | Very high | Italy (SdI), Poland (KSeF) |

| Decentralised CTC (Y model) | Invoices are exchanged via private, accredited providers (PDPs), which report invoice data to a centralised government platform. | High | France (PPF + PDPs) |

| Real-Time Reporting (RTIR) | Invoices are exchanged directly between the partners. The invoicedata must, however, be reported to the tax authorities at the same time. | Medium | Hungary (NAV) |

| Post-audit | Invoices are exchanged directly between partners (often via PEPPOL), without government approval. Verification takes place retrospectively (audits). | Low | Germany, Belgium |

These models are applied in practice in the following country profiles and show the diversity of the European e-invoicing landscape.

4. detailed country profiles in direct comparison

4.1 Germany

- Model: Post-audit. No centralised reporting system.

- Schedule (B2B):

- From 01.01.2025: Obligation to Reception of e-invoices.

- From 01.01.2027: Obligation to Shipping for companies > € 800,000 turnover.

- From 01.01.2028: Obligation to Shipping for all other companies.

- Technical standards: XRechnung and ZUGFeRD/Factur-X.

- Exchange channel: Not a regulation, but recommended: PEPPOL

- Archiving: 10 years in original format according to GoBD.

4.2 France

- Model: Decentralised CTC (“Y model”).

- Schedule (B2B):

- From 01.09.2026: Obligation to receive for all; obligation to send for large companies.

- From 01.09.2027: Shipping obligation for SMEs and micro-enterprises.

- Technical standards: Factur-X, UBL, CII.

- Exchange channel: Mandatory via accredited private platforms (PDPs) that are connected to the state platform (PPF).

- Additional requirement: E-reporting obligation for B2C and cross-border transactions.

4.3 Italy

- Model: Centralised Clearance (CTC).

- Schedule (B2B/B2C): Mandatory for almost all companies since 1 January 2019; universal since 2024.

- Technical standard: A single, strict format: FatturaPA (XML).

- Exchange channel: Exclusively via the central government platform “Sistema di Interscambio” (SdI).

- Archiving: 10 years according to the strict “Conservazione Sostitutiva” procedure.

4.4 Poland

- Model: Centralised Clearance (CTC).

- Schedule (B2B):

- From 01.02.2026: Mandatory for large taxpayers (> PLN 200 million turnover).

- From 01.04.2026: Obligation for all other taxpayers.

- Technical standard: A single national XML format: e-Faktura.

- Exchange channel: Exclusively via the central government platform “Krajowy System e-Faktur” (KSeF).

- Special feature: The KSeF platform takes over the legal archiving of invoices for 10 years.

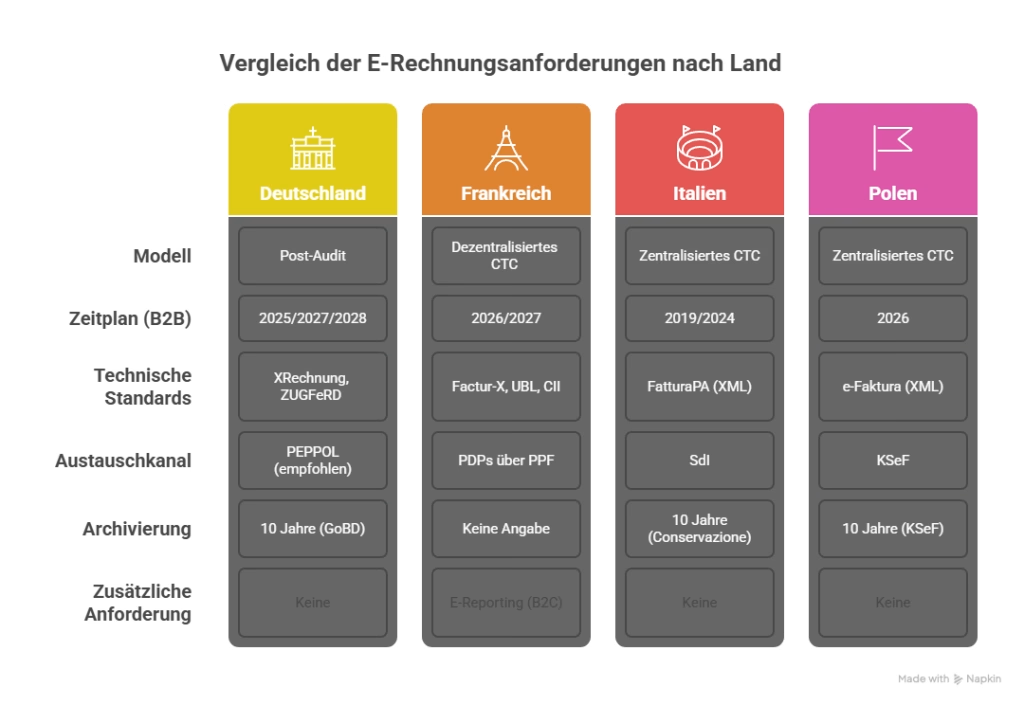

After this detailed view, the following table provides a quick, summarised overview of the most important countries.

5. general overview: the most important countries at a glance

The following overview summarises the key differences and illustrates at a glance the clear dividing line between the strict clearance models in Southern and Eastern Europe and the interoperability-based post-audit systems in Western and Northern Europe.

| Country | Scope | Model | Start date (B2B) | Central platform/network | Format(s) |

| Italy | B2G, B2B, B2C | Centralised Clearance | 2019 | Sistema di Interscambio (SdI) | FatturaPA XML |

| France | B2G, B2B | Decentralised CTC | Sept. 2026 (wave 1) | PPF (hub) + PDPs (network) | Factur-X, UBL, CII |

| Poland | B2G, B2B | Centralised Clearance | Feb. 2026 (wave 1) | KSeF | e-Faktura (XML) |

| Germany | B2G, B2B | Post-audit | Jan. 2025 (Reception) | Decentralised (PEPPOL recommended) | XRechnung, ZUGFeRD |

| Spain | B2G, B2B | Interoperability | Anticipated. 2026+ | Public/private platforms | Facturae (B2G), TBD (B2B) |

| Belgium | B2G, B2B | Post-audit | Jan. 2026 | PEPPOL (standard network) | Peppol BIS 3.0 |

This snapshot summarises the current situation. The focus is now on upcoming developments and the future of e-billing in Europe.

6 Outlook: The 2026-2028 roadmap and the future after ViDA

6.1 Timeline of the most important deadlines

The period from 2026 to 2028 marks a critical transformation phase in which a critical mass of economies are activating their B2B mandates. The following timeline serves as a strategic roadmap for prioritising implementation projects:

- 2026: Mandates in Poland (February/April), France (September), Belgium (January) and Croatia (January) come into force.

- 2027: The second wave of mandatory shipping starts in France (September), while the first wave for larger companies begins in Germany (January).

- 2028: Germany extends the shipping obligation to all companies (January).

6.2 Long-term convergence

The current phase of fragmentation with its many isolated national solutions is only temporary. The overarching goal of the ViDA initiative to introduce mandatory e-invoicing for cross-border trade by 2030 will inevitably force national systems to become interoperable. This means that even today's closed ecosystems such as the Italian SdI or the Polish KSeF will be forced to open up to cross-border trade and become interoperable with pan-European standards - a development that is likely to further strengthen the role of networks such as PEPPOL as a bridging technology.

For companies, the strategic conclusion is clear: a technological focus on the EN 16931 data model and the PEPPOL network is the only future-proof strategy. Approaches based on proprietary, country-specific protocols not only harbour the risk of inefficiency, but will inevitably become obsolete in the upcoming, harmonised European e-invoicing landscape.

Verifactu in Spain: the new invoicing obligation

The e-invoicing regulations in Europe

E-bill 2025 FAQs

Preparation for the introduction of CKS.EINVOICE

E-invoicing - The flexible EN 16931 standard

E-Invoice master data and settings in SAP Business One

Archiving of e-invoices

International e-invoices: differences and global developments

MariProject / Tool for e-invoicing