What you need to watch out for from 2025

The digitalisation of invoicing processes is progressing steadily, and from the 1 January 2025 In Germany, there is an obligation to use the E-bill comes into force. Companies of all sizes and from all sectors will then be obliged to receive electronic invoices and archive them in a legally compliant manner. Strict requirements for digital archiving already apply today. However, there are additional aspects that need to be considered when archiving e-invoices.

Legal basis for archiving invoices

Since 2011, digital invoices in formats such as PDF, XML or ZUGFeRD legally recognised as equivalent to paper invoices. This equalisation was made possible by the Tax Simplification Act. The basis for the retention obligations is the Fiscal Code (AO), the German Commercial Code (HGB) and the Value Added Tax Act (UStG). In particular the § 14b UStG regulates the storage of invoices in detail and requires that Invoices issued and received for at least 10 years must be stored. These regulations apply to both digital and paper invoices.

the GoBD (Principles for the proper management and storage of books, records and documents in electronic form and for data access) provide specific guidelines for archiving e-invoices. Invoices must be tamper-proof, unalterable and legible at all times. Companies that do not fulfil these requirements risk penalties during a tax audit.

Mandatory e-invoicing from 2025: What will companies have to face?

From the 1 January 2025 the use of E-invoices mandatory for all companies. This means that PDF invoices by e-mail future no longer permitted and are not considered e-invoices. Companies must therefore focus on the use of standardised formats such as XInvoice or ZUGFeRD that have been specially developed for digital invoice processing. However, the transitional regulations, which apply until the end of 2026, still allow companies to use paper invoices or other digital formats in agreement with the recipient.

Obligation to retain invoices: When does it begin and end?

the Retention period for invoices always begins on End of the calendar yearin which the invoice was issued. For an invoice from 27.09.2023 the period therefore begins on 31.12.2023 and ends on 31.12.2033. During this period, companies must ensure that the invoices are accessible, unaltered and analysable by machine at all times. Once this period has expired, the invoices may be destroyed unless they are still relevant for legal reasons, e.g. for legal disputes or tax audits.

Differences in the archiving of paper and e-invoices

Although paper invoices and electronic invoices are now on an equal footing in legal terms, there are still archiving Some differences that companies need to be aware of:

- E-Bills must be archived in the format in which they were received. A printout and subsequent paper archiving is not sufficient. Media discontinuities where electronic invoices are further processed in paper form must be avoided.

- Paper invoices may be digitised as long as they are then audit-proof and archived electronically in accordance with the requirements of the GoBD. This is best achieved by using a Document management software (DMS).

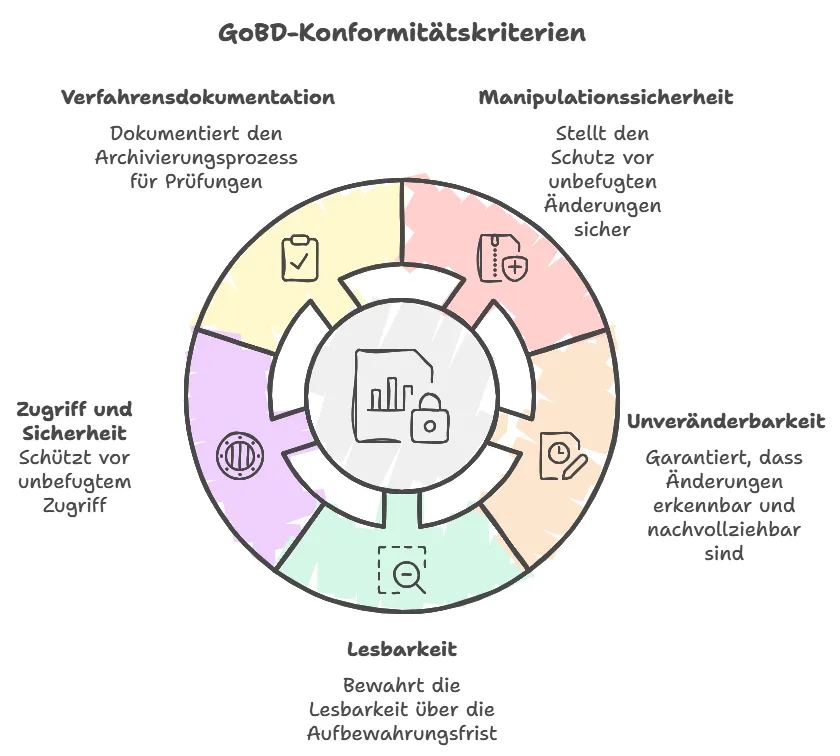

Requirements for GoBD-compliant archiving

the GoBD places clear demands on the Digital archiving of invoices. To ensure that electronic invoices are stored properly, companies must observe the following criteria:

- Tamper resistanceDigital invoices must be stored in such a way that they are protected against subsequent changes. Changes to the hardware or software must not jeopardise the integrity of the invoices.

- ImmutabilitySubsequent changes to archived invoices must be clearly recognisable and traceable. The original invoice must not be overwritten.

- ReadabilityInvoices must remain archived in a readable format for the duration of the retention period.

- Access and securityInvoices must be protected against unauthorised access. Measures such as authorisation management and logging of access should be implemented.

- procedural documentationThe entire archiving process must be described in procedural documentation. This is crucial in order to prove compliance with the GoBD during a tax audit.

E-mail and e-billing: Do you have to archive e-mails?

In connection with the archiving of e-invoices, the question often arises as to whether one should also archive the E-mailwith which the invoice is sent or received. The following applies here:

- Yesif the e-mail Additional, accounting-relevant information that are not included in the notes to the financial statements.

- Noif the e-mail is only used as Means of transport for the invoice, comparable to an envelope.

From 2025 However, the dispatch of invoices is considered PDF attachment by e-mail are no longer sufficient to fulfil the requirements for e-invoicing. Companies must therefore focus on sending and receiving invoices in formats such as XInvoice Set.

Digital signatures: a valuable tool for secure e-invoices

Digital signatures offer numerous advantages in the processing and archiving of e-invoices. They contribute significantly to Security and Integrity of documents and offer companies the opportunity to optimise their invoice processing. Here are some of the key benefits:

Main advantages of digital signatures:

- AuthenticityThe identity of the signatory is confirmed beyond doubt.

- IntegrityDigital signatures ensure that the document has not been changed after it has been signed.

- Non-repudiationThe signatory cannot deny having signed the document, as the signature is clearly linked to the signatory.

- Increased securityCryptographic processes offer strong protection against forgery and manipulation.

Further properties of digital signatures:

- TimestampDigital signatures can be provided with an exact time stamp that proves the time of signing.

- VerifiabilityThe authenticity of the signature can be verified at any time, which is particularly important for audits.

- Legal validityIn many countries, including Germany, digital signatures have the same status as handwritten signatures.

Archiving of e-invoices in SAP Business One

This process is made particularly efficient by using the cks.eINVOICE-Add-ons for SAP Business One. With cks.eINVOICE, companies can generate electronic invoices in the prescribed structured format such as XRechnung or ZUGFeRD directly from the ERP system. This means that no additional software or manual conversion of invoice data is required. The add-on ensures that all invoice data is automatically transferred to the correct format and archived in an audit-proof manner. This not only saves companies time, but also ensures full compliance with legal requirements.

Influence on the archiving of e-invoices: Signed and unsigned invoices

A frequent question in connection with the E-bill is: Does an invoice have to be digitally signed to be legally valid? The answer is clear: No. In Germany, a digital signature is not mandatory for the validity of an e-invoice. Invoices without a digital signature are just as valid and must be accepted by the recipient.

Situation with incoming invoices:

- No control over the signatureAs the invoice recipient, you have no influence on whether an incoming invoice is digitally signed. This decision lies solely with the invoice issuer.

- Processing of unsigned invoices: Companies must be able to both signed as well as unsigned process e-invoices and archive them in an audit-proof manner.

- Legal situationInvoices without a digital signature are also legally valid and are subject to the same retention obligations as signed invoices.

FAQs

Service description in the e-invoice: How much detail really needs to be included?

Verifactu in Spain: the new invoicing obligation

The e-invoicing regulations in Europe

E-bill 2025 FAQs

Preparation for the introduction of CKS.EINVOICE

E-invoicing - The flexible EN 16931 standard

E-Invoice master data and settings in SAP Business One

Archiving of e-invoices

International e-invoices: differences and global developments