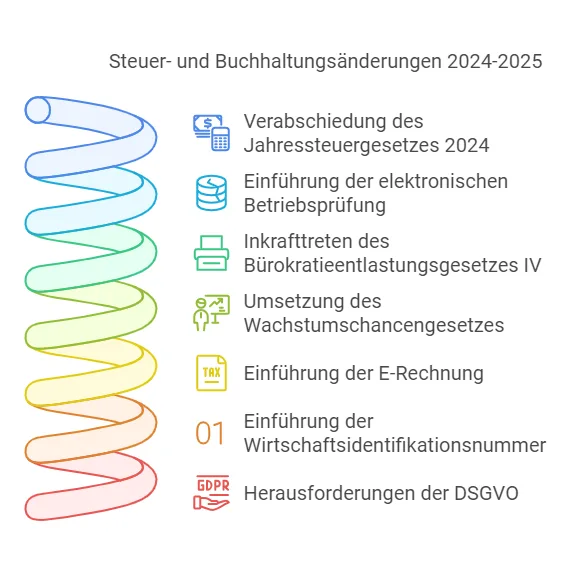

Stay informed! At the turn of the year 2024/2025, numerous changes will come into force that will financial accounting concern. We will give you an overview of the most important changes and offer practical tips for implementing them in your company.

1st Annual Tax Act 2024 - changes at a glance

That Annual Tax Act 2024 was adopted on 22 November 2024 and introduces around 130 individual measures. These amendments not only respond to EU requirements and current case law, but also correct editorial errors and clarify open technical issues. The relevant changes include simplifications for smaller companies and specific adjustments in the area of VAT.

2. digitalisation of accounting: the electronic tax audit (euBP)

From 1 January 2025, the electronic tax audit (euBP) is mandatory. Companies must transmit data from their financial accounting to the tax authorities in a digital and structured format.

Since 2023, remuneration data had to be transmitted electronically, while the transmission of financial accounting data remained voluntary until the end of 2024.

Exemptions from the obligation to carry out an EAP are possible until the end of 2026 at the latest, for example if no suitable software programme is available.

3. reduction of bureaucracy through the Bureaucracy Reduction Act IV

The 4th Bureaucracy Relief Act will also come into force on 1 January 2025 and will bring significant relief, including

- Shortened Retention periods: Particularly relevant for older accounting documents.

- Digital tax documentsIntroduction of uniform standards for digital processing.

These measures are intended to reduce costs and simplify processes. Nevertheless, the challenge for financial accounting in 2025 will be to adapt existing systems accordingly.

4th Growth Opportunities Act: liquidity and bureaucracy reduction

The Growth Opportunities Act is intended to strengthen the competitiveness of companies by reducing bureaucracy and creating financial room for manoeuvre.

Key points:

- Improved amortisation rules.

- Simplified tax procedures.

This law is closely linked to the introduction of the E-billwhich will be binding for B2B transactions in the future.

5. e-invoicing: obligation and opportunities

From 1 January 2025, e-invoicing will be mandatory for the B2B sector. Companies will benefit from:

- Faster payment processes.

- Reduced error rates.

- A standardised format for the exchange of invoices.

Tip: Nevertheless, start converting your invoicing processes at an early stage in order to utilise transition periods effectively.

6 Economic identification number: A new standard

The business identification number (W-IdNr.) provides companies with a unique identifier for communication with the authorities.

Time horizon: The allocation of the W-IdNr. started on 1 November 2024 and will take place in stages. Initially, companies do not have to take any steps of their own - the allocation is automatic.

7 GDPR and accounting

the GDPR remains a key challenge, particularly with regard to the storage of personal data. Accounting is often caught between data protection and statutory retention obligations.

Practical approach: Use the corresponding functions in SAP Business One for data that is no longer required without violating legal deadlines.

Service description in the e-invoice: How much detail really needs to be included?

Verifactu in Spain: the new invoicing obligation

The e-invoicing regulations in Europe

Versino Financial Suite V09.2025 for SAP Business One

Accounting outsourcing: Why it pays off for SMEs