Certainly the original approach was the business one accounting to those who have mastered their craft is not a stupid idea. This is especially true for small and medium-sized companies. They have neither their own accounting department nor the financial resources to employ an accountant. Such companies are happy to use external service providers for accounting in use. However, this profession always costs money.

Costs for accounting tasks

In addition to a monthly flat rate for ongoing accounting tasks, all tax returns or declarations are also invoiced. All other services, such as the administration of social security applications, must also be remunerated. This means that the amount originally calculated quickly exceeds the amount estimated in the flat rate.

Easier than expected

Taking over your own bookkeeping sounds like a complicated undertaking at first. However, tackling this restructuring is not just a question of money. Through the development of ERP systems for SMEs, many tasks that previously took a lot of time and effort (such as invoice management) have become feasible for any company. This also applies to small companies. On the one hand, this saves the costs of external bookkeeping and thus also avoids duplication of work.

Internal data access improves business processes

In addition to the financial benefits, internal accounting also has the clear advantage that you can access your own accounting data at any time. Instead of first requesting an analysis from the accountant, the ERP system only requires a few clicks. All important data can be recorded immediately at a glance. Reports and analyses can be adapted to the needs of the company and then other operational processes can be made more efficient. In addition, it has never done a company any harm that employees have qualifications in all areas. The same goes for accounting. It is particularly important for decision-makers to be able to access and evaluate data. Because such data should usually be used as a basis for decision-making. It's also in SMEs mostly the case that every employee lives in a certain self-administration, since that person is often responsible for a task independently.

Other advantages of ERP software for accounting

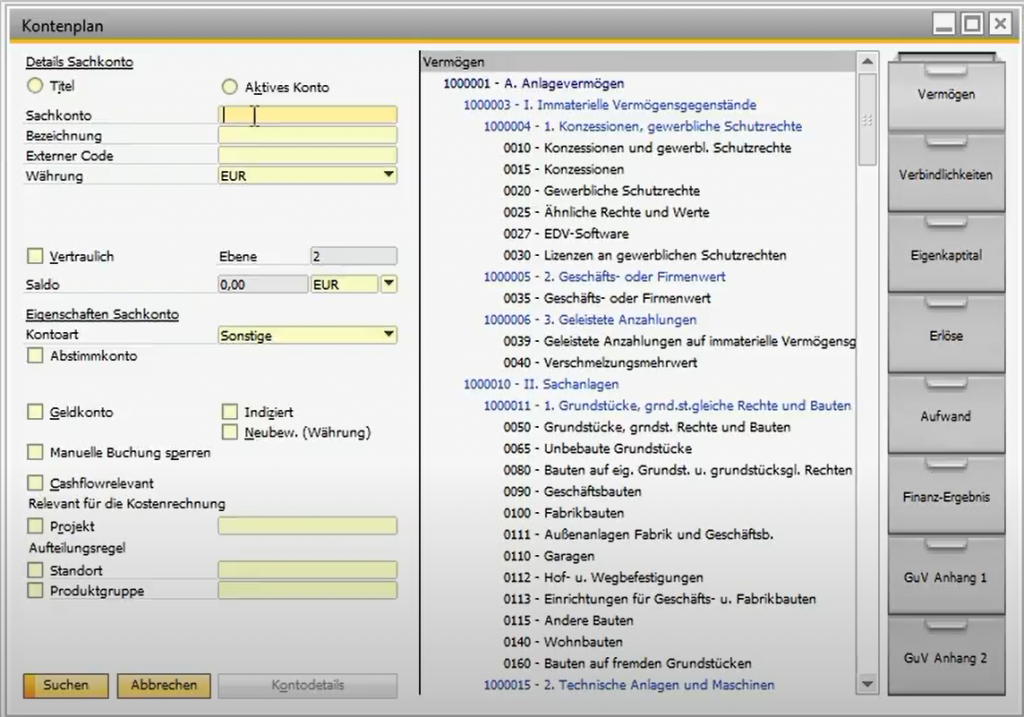

There are various options for selecting software for internal accounting. If several of the company's processes can generally be transferred to one software, it is advisable to look for an ERP solution.standard solution to keep an eye out. Systems such as SAP Business One, which have all the important standard functions, are particularly suitable for SMEs, as they are inexpensive to implement compared to a customized solution, but can be expanded at any time. Otherwise, there is also the option of one cloud-based to use providers. These solutions work particularly inexpensively. There are no acquisition or maintenance costs. In addition, the cloud has almost unlimited processing and storage options.

The advantage of the ERP systems

The advantage of ERP systems is generally that the user guidance is developed in such a way that it can be used by everyone. This means that even employees with little experience in accounting can find their way around the tasks in the system. Even changes to regulations or laws are always integrated in (good) ERP systems (e.g. through system updates). This makes it easy to submit advance VAT returns via ELSTER using the software.

As always, it makes sense to look for a suitable provider who will implement the software and support the company in the process. Vendors often bid training courses in which processes from accounting are shown on a trial basis and employees can practice using the system.

More and improved functions for financial accounting in SAP Business One

With our specially developed extension for SAP Business One, the Versino Financial Suitewe offer a customised solution for the needs of financial accounting and finance departments of SMEs. Originally developed as an interface to the DATEV Versino Financial Suite has evolved into a comprehensive set of tools. These tools optimise and refine accounting processes and increase the efficiency of your employees. You can find all the relevant details about these enhancements here.

Finance in SAP Business One

Posting periods in SAP Business One

E-bill master data and settings in SAP Business One

Moving average price in SAP Business One

SAP Business One - Open items

GOBD and GOBD myths