In SAP Business One, there are essentially two ways to effectively manage shipping and freight. One is to create item master data, the other is to use the specific freight definition function. Both approaches have their advantages and consequences, which should be recognised and taken into account when using them.

Use of article master data for shipping & freight:

Create article

Entry of new articles:

A new item is created by assigning it a unique identification number, a precise description and allocation to a item group stored in the system. If you want to offer items at a fixed price, you must also specify this.Categorisation as sales and/or purchase items:

In accordance with the planned use of the article in the business process it must be classified as either a sales or purchase item. This is particularly relevant if the item is to appear on incoming invoices.Management of inventory and planning data:

In the context of inventory management, associated ledger accounts according to the article group. For the planning data, you must specify that no specific planning method is to be used and that procurement is to be processed via the purchase. This information can also be taken automatically from the article group assignment.

Create article groups

Creating article groups is essential for structuring and efficiently managing the product range:

Definition of the article group for shipping & freight:

In addition to naming the group, the planning and procurement method must be set to 'None' or 'Buy'.Accounting settings:

The accounts for revenues and expenses of the article group must be defined in the accounting area, whereby coordination with the tax consultant is recommended. It should be noted that different account allocations are possible for domestic, EU and foreign countries.

Freight definition in detail

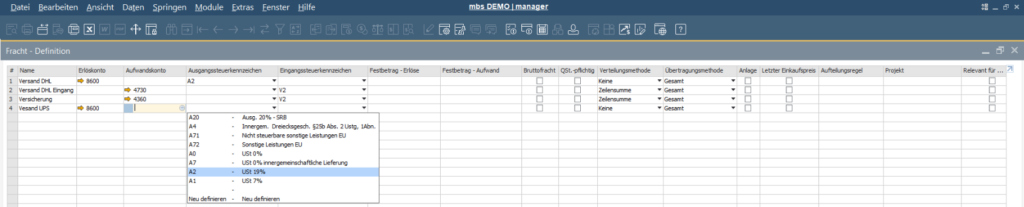

In "SAP Business One", there are various fields in the freight definition area that are necessary for the correct processing and posting of freight costs. These fields include, among others:

Description of the freight

This information appears in the sales documents. Prerequisite: The corresponding freight option is selected.Revenue account details

Required for booking outgoing freight in order to recognise income correctly.Accounts for incoming freight

Specifies the booking account for incoming freight for the recording of freight expenses.Labelling of output tax

Defines the applicable tax code for sales documents. If a definition exists in the BP master data area, the application adopts the default setting for the freight costs.Labelling of the input tax

Determines the tax code for purchasing documents. If specifications exist in the SAP Business One business partner master data, the application favours these for the freight costs.Flat rates for income and expenses

A fixed amount for freight income or expenses can be entered here. Without a fixed amount, manual entry is possible when booking freight. A stored fixed income amount appears automatically in all sales documents, and a fixed expense amount appears accordingly in purchasing documents.Gross freight marking

Does the specified amount include tax if you enter it here?Withholding tax liability

Identifies freight costs that are relevant to withholding tax (this should be clarified with a tax consultant).

Freight entries that have been defined within the freight definition window or stored as items can only be deleted if they have not yet been used in a document.

The freight definition function opens up a wide range of options for handling shipping & freight in SAP Business One

- General use: This function not only allows you to allocate freight costs to the items in a purchasing document, but also to distribute insurance amounts or other surcharges accordingly.

- Distribution methods: The freight costs can be allocated in various ways, whether based on the quantity, the volume, the weight of the items, an even distribution or according to the total of the document lines.

Transmission and distribution options

The methodology for transferring and distributing freight costs offers flexible handling in the business process:

- Transfer methods for sales documents: Various options allow the individual calculation and allocation of freight costs when copying base documents to target documents.

- Special case shipping insurance: If insurance is required in addition to the standard freight costs, a separate article group must be created in order to differentiate the postings to the corresponding accounts.

Comparison: Shipping costs management in article master vs. freight definition

| Category | Shipping as part of the article master | Shipping via freight definition |

|---|---|---|

| Eligibility for discount | Discounts cannot be applied to this article. | Discounts are applicable if they are defined in accordance with the payment and discount conditions. |

| Cost allocation in the procurement process | The shipping costs remain constant, regardless of the number of items and purchase price. | Shipping costs may vary and increase the item value and procurement costs. |

| Transmission mechanism | Shipping costs can only be paid in full, not pro rata. | The distribution of shipping costs to the target document can be customised. |

| Price definition | An item can be created with different prices for shipping; a specific selection is made in the document. | Definition of freight costs in sales as a fixed amount; in the event of deviations, the amount must be adjusted manually. |

| tax code | The tax code is permanently preset and can be easily monitored by checking the master data. | Tax codes are automatically assigned according to settings and can be changed if necessary, although a check is more complex here. |

| Remark | Freight costs can be maintained directly in the article master in the sales process. | In the purchasing process, freight is recorded separately in the freight definition. |

FAQs

New webinars: Versino Financial Suite

Secure liquidity with SAP Business One

New! Versino Financial Suite 03.2025

The cockpit of the Versino Financial Suite

Financial statements - always difficult?