The financial system in SAP Business One contains the entries that you are legally obliged to make and enriches these with many additional functions. The basis for the Accounting are the individual accounts and/or the chart of accounts. In addition to the classic accounting functions, SAP Business One Financial Management also has integrated cost accounting and asset accounting.

- Fully integrated financial accounting

- Chart of accounts in SAP Business One Financial Accounting

- G/L account determination in SAP Business One

- Journal entries in SAP Business One Financials

- Parked receipts

- Incoming payments in SAP Business One accounting

- Outgoing payments

- account assignment template

- recurring bookings

- Assistant for payments

- Foreign currency in SAP B1 Financial Accounting

- Reconciliations in SAP Business One

- Bank statement processing in SAP Business One accounting

- Budget in SAP Business One Finance

- Cash flow in SAP Business One

- Cost accounting in SAP Business One finance

- asset accounting

- SAP Business One financial reports

Fully integrated financial accounting

In SAP B1, a significant part of the postings are automatically entered into the accounting journal is managed. Or you can also post directly in the financial accounting module. This basis is supplemented with useful tools such as parked receipts, account assignment template or recurring entries. Cost accounting, which is fully integrated into SAP Business One, is more closely linked to accounting.

the asset accounting enables the user to control and check fixed assets. It is a subledger to the ledger in Business One Financial Accounting and provides ERP users with accounting information on fixed assets, for example. A module for all banking transactions is also integrated into SAP Business One Financial Management. This includes the processing of payments by cheque, cash or credit card. The financial reports provide an overview of the data generated in financial management. These create transparency regarding profit and loss, cash flowdue dates and profit centres in the company.

Chart of accounts in SAP Business One Financial Accounting

When creating a company in SAP Business One Financial Accounting, you can specify whether you want to use a predefined or customised chart of accounts want to set up.

The charts of accounts already defined also fulfil the accounting regulations of the respective country and are prepared according to the model of a Joint chart of accounts or standard chart of accounts. You can use the existing templates accordingly, SKR03, SKR04 or IKR, start with German accounting. Of the chart of accounts in SAP Business One is, figuratively speaking, organised like a filing cabinet. This chart of accounts is organised in accordance with the structure of the balance sheet and the Profit and Loss Account is divided into the categories assets, liabilities, equity, income, expenses and financial result. The respective drawers of the cabinet form the structure and roughly follow the account classes of the standard chart of accounts.

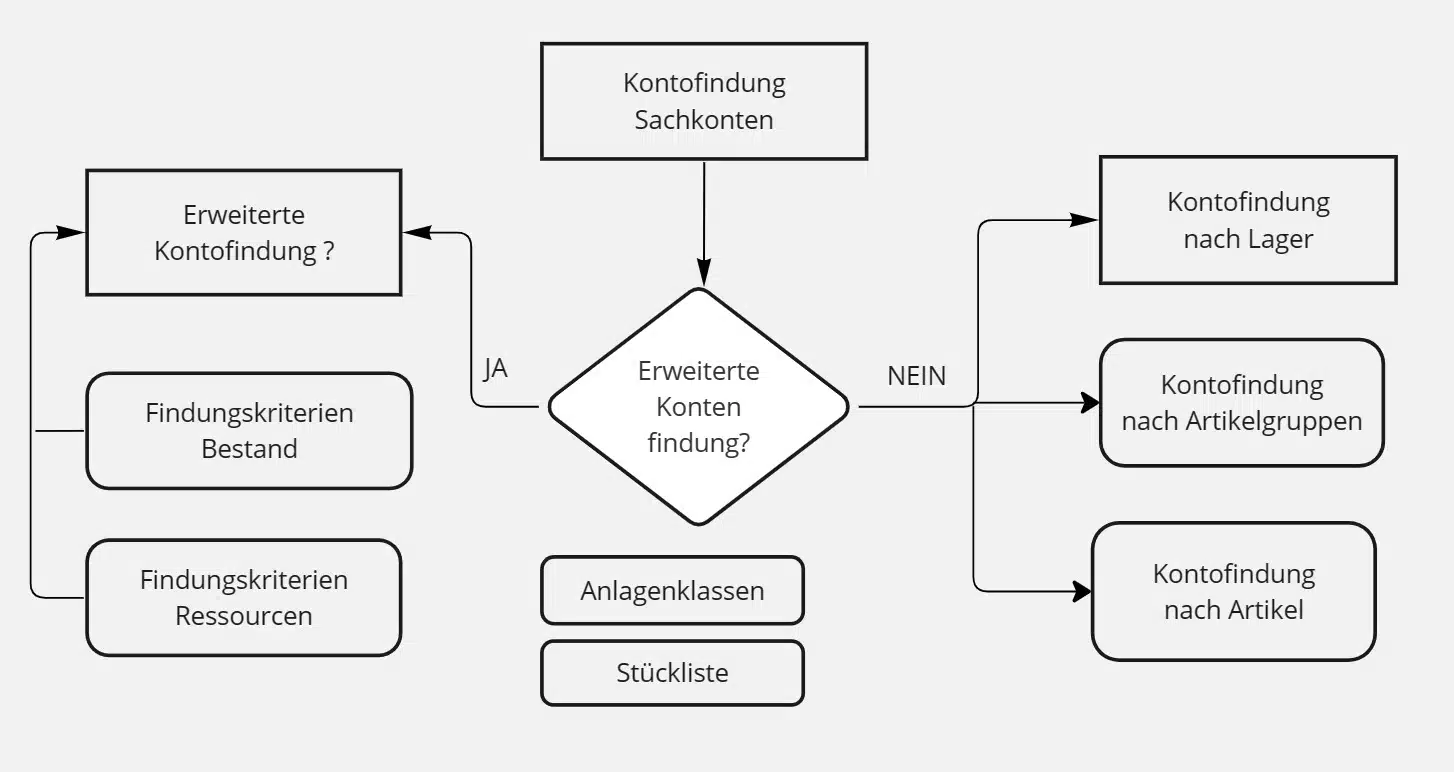

G/L account determination in SAP Business One

The basis for the automated postings in SAP Business One is the G/L account determination. This G/L account determination defines a number of account assignments in Financial Accounting, which from now on regulate all automatic postings of the individual document types. If you

uses a standard chart of accounts,

the account assignments are largely assigned automatically. If a company operates with an individual chart of accounts, the "G/L account determination" can also be customised. In principle, most of the accounts required for automatic postings are set via the G/L account determination. Although revenue postings, expense postings and inventory postings must be presented in a more differentiated manner, the

Account determination after camparticle group or article, which then overlays the G/L account determination.

If, for example, even more detailed control is required, the Extended account determination use. This deactivates account determination according to camp, item group or article. In the extended account determination, field contents can be read out and the corresponding accounts are selected depending on the result.

In addition to the procedure described above, there are also settings for account determination in the asset classes in SAP Business One Financial Accounting.

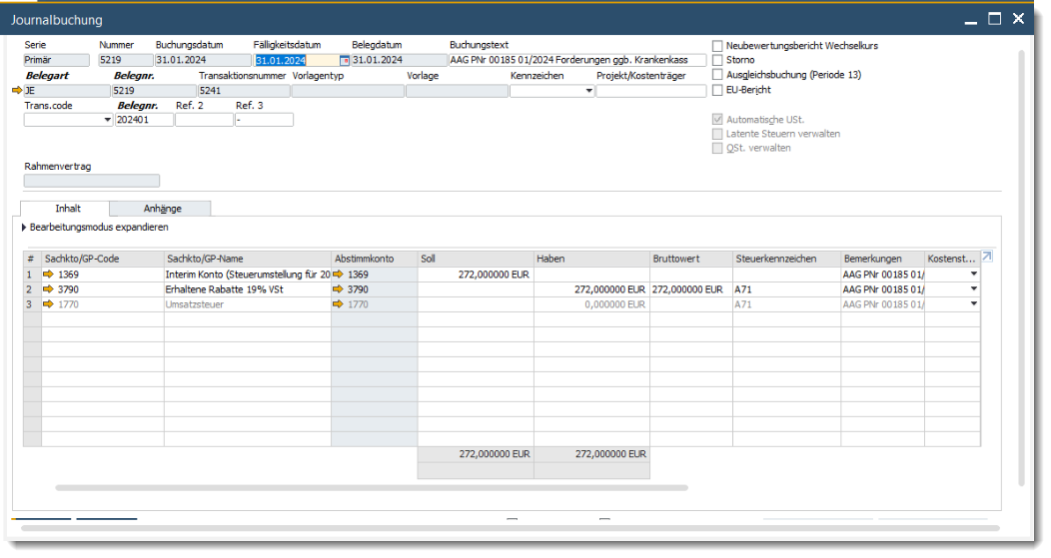

Journal entries in SAP Business One Financials

A journal entry is used to post data directly to the database.

A journal entry is the documentation of a transaction. It usually contains a transaction date, the title of the accounts concerned, the amount in debit and credit and the transaction description. Each system document from the modules sale, PurchasingThe entry for the transaction, payment and inventory that affects a G/L entry automatically creates a journal entry in the background. Therefore, you can only add a journal entry if the posting is balanced (debit and credit are equal). journal entries can no longer be changed after it has been added. Instead, you can only cancel. The only exception is the Distribution rule represent.

In SAP Business One Accounting, you can start a journal entry without finalising it (i.e. without posting it directly to the general ledger) by using a journal voucher. These journal vouchers can be useful if you have a longer entry to create and need to come back. You can start entering data and save a journal entry as a draft, even if it is not balanced.

Parked receipts

You can also use existing parked receipts with journal entries. In other words, you can create a journal voucher that contains several journal entries. Another advantage is that employees can enter postings in advance, which are then finalised by an experienced specialist from the accounting department. Companies with high compliance requirements can also implement a dual control principle for accounting.

Incoming payments in SAP Business One accounting

Incoming payments have four options: Cash, cheque, bank transfer and credit card. SAP Business One processes them all in the same way: by means of a corresponding incoming payment against a specific outgoing invoice or by an outgoing payment to a debtor against two or more sales invoices.

Outgoing payments

There are also four ways to send outgoing payments: Cash, cheques, credit and debit cards and bank transfers. The activities listed below can be carried out with outgoing payments: Outgoing payments create cheques for business partners and accounts with different payment methods; print and validate cheques for payment for different purposes.

account assignment template

account assignment template are a tool that provides you with efficient support for identical or similar ongoing postings. The idea is to specify the structure of postings that occur repeatedly in accounting (e.g. cash purchase of consumables) and only use the amounts for this posting.

recurring bookings

Recurring entries are - analogue to account assignment models - an instrument,

which SAP Business One Financials offers to accounting more effectively. SAP B1 automatically suggests recurring postings which, in addition to the posting record, are also identical in terms of amount. Typical examples here are rent, leasing, insurance and similar.

Assistant for payments

SAP Business One has a payment wizard that allows users to create outgoing payments in batches for cheques and bank transfers and process incoming payments by bank transfer in batches. The payments are generated according to the company's selection criteria and payment methods.

Foreign currency in SAP B1 Financial Accounting

SAP Business One also has all the prerequisites for managing foreign currencies. These are covered by a wide range of functions. The currency system in SAP Business One consists of a three-part system:

- Local currency

The local currency corresponds to the currency you define for your company. - System currency

The system currency is managed in parallel to your local currency and is a (different) currency. Each account balance is also displayed in the system currency in addition to the local currency. This provides an additional currency that can be used for reporting purposes. - Account currency or document currency

This is the currency specifically assigned to the G/L account, business partner or document.

Reconciliations in SAP Business One

Internal vote

the internal poll is a procedure that is carried out in the background of SAP Business One and affects documents automatically. When a payment is made or a document is removed from an invoice and a posting is made in the ledger is made, an internal reconciliation process normally takes place. However, users also have the option of carrying out the internal reconciliation manually.

External voting

External reconciliation is the reconciliation of transactions that take place in SAP Business One with external transactions. However, there are two types of reconciliation. One option is to reconcile each individual bank transaction, such as deposits, charges, payments and loans, with each individual journal entry in SAP Business One. However, it is also possible to reconcile the journal entries in SAP Business One with a closing balance of the bank account.

Bank statement processing in SAP Business One accounting

Bank statement processing can be used to automatically import bank files into the financial system. Part of the import process allows users to make payments and other adjustment transactions by checking matching criteria automatically in SAP Business One. At the same time, the majority of transactions are synchronised externally. Users can then complete the rest manually. The add-on module also allows the creation of bank files that can be sent to the bank for transfer.

Budget in SAP Business One Finance

With SAP Business One, one can budget be created within the program running on the

chart of accounts structure. For this purpose, the budget is created on the basis of the individual G/L accounts. This then enables a direct comparison between the budget and the company's actual figures.

With the Budget Distribution Methodn the distribution of a budget over the financial year can be realised. SAP Business One recognises three methods of budget distribution

- evenly, with the budget being spread over the year

- in ascending order, with the budget amounts increasing per month over the course of the year

- descending, with the budget amounts decreasing per month over the course of the year

budget scenarios

Budget scenarios are used in SAP Business One for different tasks:

- planning

- tracking

- reporting

SAP Business helps to analyse the financial status of a department, a unit or the entire company. Guidelines are defined and the business period in which they are to apply is determined.

A main budget scenario is generated when a new company is founded. This can no longer be deleted later. The main budget is still addressed when a new posting period is created.

Cash flow in SAP Business One

SAP Business One provides detailed information about the company's cash flow situation. The system provides forecasts as to when which income and expenditure will have an impact and how, and what scope is available for investment.

When generating a cash flow forecast, you can determine a few parameters individually:

- Selection of transactions to be included

- Determination of the Opening balances

- Determination of the time axis

SAP Business One - Cash Flow Definition Cost accounting in SAP Business One finance

In SAP Business One, you can enter costs that originate from expense or revenue postings, cost centersdimensions and projects. Projects can be understood as cost units. They can also be used to collect specific project costs be used.

Collecting means that you can record transactions that have an impact on the result. In addition, there can be direct postings in the general ledger that have a link to cost centres, dimensions or projects.

The projects

In SAP Business One, this is also referred to as a financial project, as there is also an organisational project management, which in turn can be linked to the financial project. Furthermore, the link to a Project can already be defined in the business partner master data. In addition or as a substitute, a project can also be permanently assigned to one or more G/L accounts. Projects can also be stored for assets.

However, the project can already be assigned to transactions that are not initially posted. This can be the case for purchase orders, quotations and orders. In such an example, the project is "taken along" until it is posted with the journal entry. An alternative option is to assign the project in the document line

Cost centers in SAP finance

The second cost accounting instance after the project, where costs and revenues are accumulated, is the cost centre. In SAP Business One, you have the option of managing cost centres one-dimensionally or multi-dimensionally. One-dimensional means that you can allocate costs in the conventional sense up to the entire expense or revenue once per allocation rule to one or more cost centres. It is also possible to allocate the amount from the expense posting or revenue posting using Distribution key distributed multiple times to one or more cost centers from different dimensions.

cost accounting adjustment

The functionality enables the adjustment of bookings between the

individual cost centers.

asset accounting

SAP Business One provides the necessary tools to do this Fixed assets of the company in the system. Asset master data can be set up that contains an asset and its depreciation. It is also possible to capitalise and depreciate assets. The asset can be calculated on a monthly or daily basis and depreciated using the declining balance method. Special depreciation can also be applied. A multi-stage process ensures transparency: in the general ledger, you determine the depreciation on the basis of acquisition and production costs, useful life and posting. All transactions relating to fixed assets are recorded in a subledger. Apart from this, you can comprehensively analyse your asset-specific data at any time.

In summary, the asset accounting module of SAP Business One offers the following functions:

- Set up asset master data to track assets and their depreciation

- Capitalisation of assets

- Depreciation of assets

- Monitoring and planning of depreciation and amortisation

- Generating reports to analyse the financial impact of investments

- Integration into the SAP Business One system for centralised and easily accessible data management

SAP Business One financial reports

Financial reports are an integral part of the SAP Business One financial system. These reports are structured in groups.

Some reports from the group in detail:

G/L accounts and business partners

This report provides an overview of all ledger accounts and business partners with the current balance. In the selection area "G/L accounts and business partners - selection criteria", you can define filters for business partners by code, group and properties on the left-hand side. To do this, the "BP" option must be activated by ticking the corresponding box. Furthermore, you can also use the "Show interested parties" option to Interested parties without booking-relevant data by activating the corresponding checkbox.ledger

The general ledger report shows all journal entries by G/L account or per business partner.

- The filter criteria for G/L accounts and business partners are defined in the same way as in the "G/L accounts and business partners" report. Restrict the display of postings by posting date, document date and due date.

- In the lower part of the "General ledger - criteria" selection area, you can sort your data according to various parameters such as account code, cost centre, document number or contra account.

- You will find further selection options in the centre of the window.

- To display only the accounts that have a balance, activate the option "Hide accounts with zero balance". If you want to hide accounts without bookings, select the option "Hide accounts without bookings".

Receivable & Liability

The maturity reports for loans and advances to customers and liabilities to suppliers contain a list of open outgoing invoices or incoming invoices.Posting Journal Report

This report contains a list of all transactions, sorted by voucher type. This report provides you with a detailed display of all postings, sorted by voucher type. In the "Posting Journal Report - Selection Criteria" window, you will find a selection list with all voucher types that trigger automatic postings.document journal

The report shows a typical journal report with a chronological list of transactions.tax report

This report shows a list of all entries that were created after the tax code are groupedTransaction Journal Report

This report shows posted journal entries broken down by journal entry number. You can generate breakdowns to display additional information about the transactions.Inventory audit report

This report shows all items listed in the inventory. It also provides details of the transactions booked in relation to the items and costs for the remaining stock quantity.balance sheet

the balance sheet provides an overview of all assets and liabilities of a company at a defined point in time. The report definition also specifies whether it should be an annual balance sheet, quarterly balance sheet, monthly balance sheet or periodic balance sheet. You also specify which currencies are to be displayedList of totals and balances (SuSa)

The report is a list of all balances based on the G/L accounts and business partners. Criteria can be assigned. This applies to G/L accounts, business partners, currency, time periods, etc.Profit and Loss Account

the Profit and Loss Account is an overview of all expenses and expenditure and the associated profit or loss in a period.cash flow

The cash flow report is a weekly presentation of all planned and actual cash inflows and outflows of the company. All cash accounts with the corresponding cash flows are taken into account. At the same time, the future cash surplus and cash deficit are calculated on the basis of the due dates of the individual accounts. In addition, future or recurring bookings Schedule. Planned incoming and outgoing payments that are not yet available in document form can also be phased in.

Service description in the e-invoice: How much detail really needs to be included?

Verifactu in Spain: the new invoicing obligation

The e-invoicing regulations in Europe

Versino Financial Suite V09.2025 for SAP Business One

Accounting outsourcing: Why it pays off for SMEs